Artificial intelligence has three significant incomes for the insurance business. The new wave of Artificial Intelligence in the insurance industry is going to bring this paradigm shift where adopting advanced, seamless digital solutions will process the claims rapidly.

Artificial Intelligence (AI) in Insurance | Datamation Anyone working in insurance knows the business is data-driven and time intensive.

Artificial Intelligence and Insurance Industry - Policybazaar Insurers have big ambitions for artificial intelligence (AI), which we define as computer systems that can sense their environment, then think, learn and take action in response.

How is Artificial Intelligence in Insurance addressing key The expansion in the use of AI in the insurance industry comes from the trends of increased automation, data mining of Big Data, and analysis of information retrieved from the Internet of Things (IoT).

This has allowed them to deploy data modeling, predictive analysis, and machine learning across the With the rise of artificial intelligence, which analyzes and learns from massive sets of digital information culled from public and private sources, insurers are embracing the technologys many facets from machine learning and natural language

Artificial Intelligence & Machine Learning Radically

July 29, 2020. referred to as

Gradient AI is a leading provider of proven artificial intelligence solutions for the insurance industry.

Artificial Intelligence According to Deloitte, AI is the technology on which insurers will spend the most in order to improve operational efficiency. 2.Product and marketing deliver customers an exceptional experience with AI tools that are welcoming, efficient and secure.

Artificial Intelligence and Machine Learning in the Insurance Industry The expansion in the use of AI in the insurance industry comes from the trends of increased automation, data mining of Big Data, and analysis of information retrieved from the Internet of Things (IoT). Why the insurance industry needs AI solutions; What insurers are already doing in this area, and; How AI will impact the industry in the foreseeable future. Issue: Artificial intelligence (AI) is a technology which enables computer systems to accomplish tasks that typically require a human's intelligent behavior.

A report by McKinsey reports that across an array of functions and use cases AI investments, AI in the insurance industry can drive up to a whopping $1.1 trillion in potential annual value.. As insurers increasingly adopt technology, they are beginning to focus on AI (Artificial Intelligence) as their next big growth opportunity. Here's how machine learning is changing the underwriting process.

qlutter Artificial Intelligence An additional 54% have started implementing AI and are looking to grow. Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks.

insurance industry Conclusion. Under the agreement, Carahsoft will serve

AI for insurance companies: PwC

AI already works under the radar in the insurance industry. How Artificial Intelligence Is Reshaping the Insurance IndustryRisk Assessment and Underwriting. The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process.Personalised Offering. Today, it has become imperative that the insurance company becomes an integral part of the user's life so that it can offer the user customised journeys.Availability. In this report we include applications that affect care delivery, including both how existing tasks are performed and how they are disrupted by changing healthcare needs or the processes required to address them, says McKinsey.. We also include applications that enhance and improve healthcare delivery,

tangible showing Artificial Intelligence unwitting demise Sounds hard to believe!

qlutter affect Dec 13, 2019 Process automation Artificial intelligence (AI) is being heralded as a potential game-changer in the pharmaceutical industry, with the potential to speed up drug development, improve decision making, and reduce costs. Whereas, AI can analyze potential risks and help develop customer-specific marketing tactics. AI is turning the insurance industry around. 00:00:17 - Many insurers had to quickly embrace technology and adapt to new ways of doing business during the pandemic, but how much of that will be retained a Artificial Intelligence in Insurance Market report covers the current state of business and the growth prospects of the worldwide Artificial Intelligence in Insurance Market.

Artificial Intelligence Artificial intelligence is likely to affect the entire landscape of insurance as we know it.

Artificial Intelligence Customers, too, are benefitting from practices like comparative shopping, quick claims processing, around-the-clock service and improved decision management. Artificial Intelligence (AI) has transformed industries through its evolved predictive capabilities and superior decision making.

intelligence artificial insurance industry magoosh science data aman goel january

intelligence artificial insurance industry magoosh science data aman goel january Change is here, more is coming. Artificial Intelligence (AI) in Insurance Datamation.

Artificial Intelligence in Insurance

Artificial intelligence investments pay off, according to McKinsey, which forecasts that AI investments in the insurance business may generate up to $1.1 trillion in potential annual value across functions and use cases.. Now, insurance companies are forced to shift from relying on personal interactions to digital interfaces. Washington (August 20, 2020) On August 14, 2020, members of the National Association of Insurance Commissioners (NAIC) unanimously adopted guiding principles on artificial intelligence (AI) emphasizing the importance of accountability, compliance, transparency, and safe, secure and robust outputs. These task involve G athering information; Analyzing data by running models for example of projected sales. AI can help automate labor intensive processes, leading to lower costs and saved time. The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries.

Artificial intelligence and risk management The insurance industry has many opportunities to take advantage of Artificial Intelligence (AI). 4.6x $ 47B increase of AI deals from 2012 to 2016 projected overall spend of by 2020 of insurance companies invest in AI in 2016 35.6M

automation industry How Artificial Intelligence Is Helping the Insurance industry The advancements in Artificial Intelligence are bringing a seismic, tech-driven shift.

Artificial Intelligence Toggle navigation; Login; Dashboard; AITopics An official publication of the AAAI. AI authenticity. AI is already becoming a disruptive force in the insurance industry by allowing companies to automate services like claims management, customer service, and document creation. There are a number of reasons for this, but the most important one is that AI can help improve efficiency and accuracy in a number of areas.

Artificial Intelligence Through artificial intelligence and behavioral economics, Lemonade recently set a world record for payment of the claim in 3 seconds with zero paperwork. Insurance Quotes.

emerj The introduction of usage-based insurance, however, has created an effective means to provide the right insurance for the right price based on specifics, not assumptions.

imaginea A Brief Overview of Artificial Intelligence. Whether we talk about retail, hospitality or healthcare, AI has driven exponential growth in each industry. As per a recent report, the artificial intelligence (AI) in insurance market size is valued at USD 6.92 billion by 2028 and is expected to grow at a compound annual growth rate of 24.05% in the forecast period of 2021 to 2028 ( source ).

Artificial Intelligence in Insurance UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland.Co-headquartered in the cities of Zrich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world.

Its time for insurers to rethink their business models and incorporate AI. The insurance industry, after the trade market, is another sector where it is hard to predict the next big paradigm shift.

Insurance Industry UBS Get the latest Pittsburgh local news, breaking news, sports, entertainment, weather and traffic, as well as national and international news, from the Pulitzer Prize-winning staff of the Pittsburgh Post-Gazette. In conclusion, artificial intelligence and big data are important in the insurance industry as they help insurers improve fraud detection rates, offer more accurate quotes, and reduce claims processing time. A n insurance firm recently released a claim within seconds using its bots. There are already several examples of AI in use in the pharmaceutical industry.

Artificial Intelligence In such a competitive environment, many insurers are restricted to paper-based infrastructures and legacy IT implementation thus limiting their ability to make

5 Ways Artificial Intelligence Could Impact the Insurance Industry Artificial Intelligence in Insurance - Deloitte US 01 Fraud Detection. Explore articles and analysis related to artificial intelligence in finance, including coverage of banking, insurance, fintech, and more. Hint: single-payer wont fix Americas health care spending. Food manufacturers using artificial intelligence, robotics, and other machine learning are exposed to some unpredictable risks. AI in insurance How is artificial intelligence impacting the .

How artificial Intelligence is changing insurance - FinTech Magazine Given the tentative stability and natural catastrophes, insurance companies often stand on a trembling ground and confront massive challenges, even when it comes to adopting seamless and intuitive digital solutions such as Artificial Intelligence in Likewise, it could have a big impact on the insurance industry. Risk Assessment and Underwriting. and enhanced customer experience.

Artificial Intelligence In Insurance Industry The application of artificial intelligence (AI) in the insurance industry is already ongoing and will substantially increase over the next decade. When performed manually, these services are time-consuming and often rife with human errors. July 29, 2020. Also, the insurance industry is going through a major transformation.

Heres a look at how AI-driven UBI might impact the industry. While the concept might still seem somewhat futuristic, artificial intelligence (AI) is now truly part of our daily lives. However, the industry certainly views AI as a game-changer in terms of faster data processing, smarter operations, and improved customer experiences. The insurance industry is no different.

Artificial Intelligence AITopics Artificial Intelligence Launched in 2012, it handles the claims through an in-app chatbot.

Artificial Intelligence In Insurance Fecund Software Services LLC Artificial Intelligence How Artificial Intelligence Is Helping

Artificial Intelligence In Insurance Fecund Software Services LLC Artificial Intelligence How Artificial Intelligence Is Helping Artificial Intelligence (AI) is a computer-assisted anal ytical course that attempts to form automated systems which can be. With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. However, now, as Artificial Intelligence is catalyzing its growth, things are changing for good. However, the silver lining is that it has reinforced the importance of technology more firmly, especially Artificial Intelligence (AI) and Cloud Computing for this specific sector..

Leveraging Artificial Intelligence (AI) in Insurance Industry Insurance companies have been utilizing smart contracts for quite some time now.

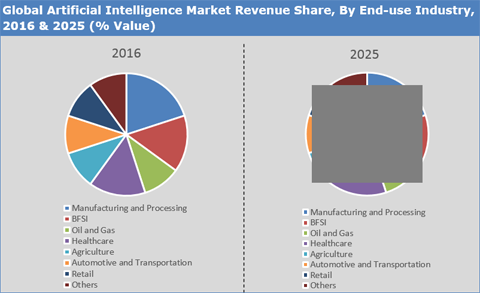

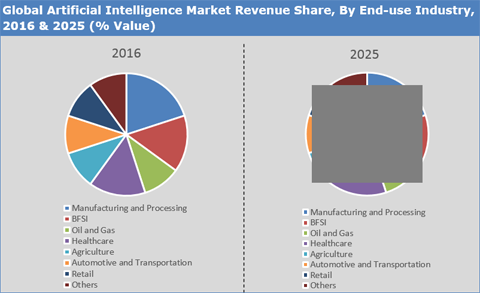

artificial intelligence market healthcare industry end use bfsi banking agriculture processing manufacturing transportation insurance financial automotive retail gas others oil The Limits Of Artificial Intelligence In Insurance Artificial Intelligence (AI) in Insurance. Insurance organizations can use AI to mine piles of records for useful data. Underwriters can use that data to speed up reviews of requests for coverage. Marketers can use the data to predict what policyholders will do. Artificial Intelligence (AI) and natural language processing are rapidly changing the insurance industry. The insurance industry is seeing a welcome disruption via artificial intelligence (AI), but only a few companies might benefit from this breakthrough. There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims.

insurance intelligence artificial motor technology automotive handling transform claims youtalk pwc vehicles upgraded continuously With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. Artificial Intelligence (AI) in the insurance industry i s a form of technology that allows computer systems to accomplish task s without human intervention. The percentage dropped to 62% for ranks 21 to 50 and 51% for the rest

AI and the Insurance Industry | AmTrust Financial Insurance Here are the top findings from insurers who participated in our survey of US companies actively using AI: the top benefits they see, the top obstacles they report and how to overcome those obstacles.

Artificial Intelligence The Future of Insurance Industry | Mindtree [] UBS client services are known for their strict bankclient confidentiality and culture Customers may enjoy a more seamless user experience and more affordable rates. Artificial Intelligence, Digitization & Agent Experience 3 trends reshaping the insurance.

Artificial intelligence: Delivering on insurance industry expectations Business Insurance.

powered by i 2 k Connect.

Artificial Intelligence on The Insurance Industry

Sitemap 19

This has allowed them to deploy data modeling, predictive analysis, and machine learning across the With the rise of artificial intelligence, which analyzes and learns from massive sets of digital information culled from public and private sources, insurers are embracing the technologys many facets from machine learning and natural language Artificial Intelligence & Machine Learning Radically

This has allowed them to deploy data modeling, predictive analysis, and machine learning across the With the rise of artificial intelligence, which analyzes and learns from massive sets of digital information culled from public and private sources, insurers are embracing the technologys many facets from machine learning and natural language Artificial Intelligence & Machine Learning Radically

July 29, 2020. referred to as

July 29, 2020. referred to as  Gradient AI is a leading provider of proven artificial intelligence solutions for the insurance industry. Artificial Intelligence According to Deloitte, AI is the technology on which insurers will spend the most in order to improve operational efficiency. 2.Product and marketing deliver customers an exceptional experience with AI tools that are welcoming, efficient and secure. Artificial Intelligence and Machine Learning in the Insurance Industry The expansion in the use of AI in the insurance industry comes from the trends of increased automation, data mining of Big Data, and analysis of information retrieved from the Internet of Things (IoT). Why the insurance industry needs AI solutions; What insurers are already doing in this area, and; How AI will impact the industry in the foreseeable future. Issue: Artificial intelligence (AI) is a technology which enables computer systems to accomplish tasks that typically require a human's intelligent behavior.

Gradient AI is a leading provider of proven artificial intelligence solutions for the insurance industry. Artificial Intelligence According to Deloitte, AI is the technology on which insurers will spend the most in order to improve operational efficiency. 2.Product and marketing deliver customers an exceptional experience with AI tools that are welcoming, efficient and secure. Artificial Intelligence and Machine Learning in the Insurance Industry The expansion in the use of AI in the insurance industry comes from the trends of increased automation, data mining of Big Data, and analysis of information retrieved from the Internet of Things (IoT). Why the insurance industry needs AI solutions; What insurers are already doing in this area, and; How AI will impact the industry in the foreseeable future. Issue: Artificial intelligence (AI) is a technology which enables computer systems to accomplish tasks that typically require a human's intelligent behavior.  A report by McKinsey reports that across an array of functions and use cases AI investments, AI in the insurance industry can drive up to a whopping $1.1 trillion in potential annual value.. As insurers increasingly adopt technology, they are beginning to focus on AI (Artificial Intelligence) as their next big growth opportunity. Here's how machine learning is changing the underwriting process. qlutter Artificial Intelligence An additional 54% have started implementing AI and are looking to grow. Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. insurance industry Conclusion. Under the agreement, Carahsoft will serve AI for insurance companies: PwC

A report by McKinsey reports that across an array of functions and use cases AI investments, AI in the insurance industry can drive up to a whopping $1.1 trillion in potential annual value.. As insurers increasingly adopt technology, they are beginning to focus on AI (Artificial Intelligence) as their next big growth opportunity. Here's how machine learning is changing the underwriting process. qlutter Artificial Intelligence An additional 54% have started implementing AI and are looking to grow. Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. insurance industry Conclusion. Under the agreement, Carahsoft will serve AI for insurance companies: PwC  AI already works under the radar in the insurance industry. How Artificial Intelligence Is Reshaping the Insurance IndustryRisk Assessment and Underwriting. The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process.Personalised Offering. Today, it has become imperative that the insurance company becomes an integral part of the user's life so that it can offer the user customised journeys.Availability. In this report we include applications that affect care delivery, including both how existing tasks are performed and how they are disrupted by changing healthcare needs or the processes required to address them, says McKinsey.. We also include applications that enhance and improve healthcare delivery, tangible showing Artificial Intelligence unwitting demise Sounds hard to believe! qlutter affect Dec 13, 2019 Process automation Artificial intelligence (AI) is being heralded as a potential game-changer in the pharmaceutical industry, with the potential to speed up drug development, improve decision making, and reduce costs. Whereas, AI can analyze potential risks and help develop customer-specific marketing tactics. AI is turning the insurance industry around. 00:00:17 - Many insurers had to quickly embrace technology and adapt to new ways of doing business during the pandemic, but how much of that will be retained a Artificial Intelligence in Insurance Market report covers the current state of business and the growth prospects of the worldwide Artificial Intelligence in Insurance Market. Artificial Intelligence Artificial intelligence is likely to affect the entire landscape of insurance as we know it. Artificial Intelligence Customers, too, are benefitting from practices like comparative shopping, quick claims processing, around-the-clock service and improved decision management. Artificial Intelligence (AI) has transformed industries through its evolved predictive capabilities and superior decision making.

AI already works under the radar in the insurance industry. How Artificial Intelligence Is Reshaping the Insurance IndustryRisk Assessment and Underwriting. The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process.Personalised Offering. Today, it has become imperative that the insurance company becomes an integral part of the user's life so that it can offer the user customised journeys.Availability. In this report we include applications that affect care delivery, including both how existing tasks are performed and how they are disrupted by changing healthcare needs or the processes required to address them, says McKinsey.. We also include applications that enhance and improve healthcare delivery, tangible showing Artificial Intelligence unwitting demise Sounds hard to believe! qlutter affect Dec 13, 2019 Process automation Artificial intelligence (AI) is being heralded as a potential game-changer in the pharmaceutical industry, with the potential to speed up drug development, improve decision making, and reduce costs. Whereas, AI can analyze potential risks and help develop customer-specific marketing tactics. AI is turning the insurance industry around. 00:00:17 - Many insurers had to quickly embrace technology and adapt to new ways of doing business during the pandemic, but how much of that will be retained a Artificial Intelligence in Insurance Market report covers the current state of business and the growth prospects of the worldwide Artificial Intelligence in Insurance Market. Artificial Intelligence Artificial intelligence is likely to affect the entire landscape of insurance as we know it. Artificial Intelligence Customers, too, are benefitting from practices like comparative shopping, quick claims processing, around-the-clock service and improved decision management. Artificial Intelligence (AI) has transformed industries through its evolved predictive capabilities and superior decision making.  intelligence artificial insurance industry magoosh science data aman goel january Change is here, more is coming. Artificial Intelligence (AI) in Insurance Datamation. Artificial Intelligence in Insurance

intelligence artificial insurance industry magoosh science data aman goel january Change is here, more is coming. Artificial Intelligence (AI) in Insurance Datamation. Artificial Intelligence in Insurance  Artificial intelligence investments pay off, according to McKinsey, which forecasts that AI investments in the insurance business may generate up to $1.1 trillion in potential annual value across functions and use cases.. Now, insurance companies are forced to shift from relying on personal interactions to digital interfaces. Washington (August 20, 2020) On August 14, 2020, members of the National Association of Insurance Commissioners (NAIC) unanimously adopted guiding principles on artificial intelligence (AI) emphasizing the importance of accountability, compliance, transparency, and safe, secure and robust outputs. These task involve G athering information; Analyzing data by running models for example of projected sales. AI can help automate labor intensive processes, leading to lower costs and saved time. The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Artificial intelligence and risk management The insurance industry has many opportunities to take advantage of Artificial Intelligence (AI). 4.6x $ 47B increase of AI deals from 2012 to 2016 projected overall spend of by 2020 of insurance companies invest in AI in 2016 35.6M automation industry How Artificial Intelligence Is Helping the Insurance industry The advancements in Artificial Intelligence are bringing a seismic, tech-driven shift. Artificial Intelligence Toggle navigation; Login; Dashboard; AITopics An official publication of the AAAI. AI authenticity. AI is already becoming a disruptive force in the insurance industry by allowing companies to automate services like claims management, customer service, and document creation. There are a number of reasons for this, but the most important one is that AI can help improve efficiency and accuracy in a number of areas. Artificial Intelligence Through artificial intelligence and behavioral economics, Lemonade recently set a world record for payment of the claim in 3 seconds with zero paperwork. Insurance Quotes. emerj The introduction of usage-based insurance, however, has created an effective means to provide the right insurance for the right price based on specifics, not assumptions. imaginea A Brief Overview of Artificial Intelligence. Whether we talk about retail, hospitality or healthcare, AI has driven exponential growth in each industry. As per a recent report, the artificial intelligence (AI) in insurance market size is valued at USD 6.92 billion by 2028 and is expected to grow at a compound annual growth rate of 24.05% in the forecast period of 2021 to 2028 ( source ). Artificial Intelligence in Insurance UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland.Co-headquartered in the cities of Zrich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world.

Artificial intelligence investments pay off, according to McKinsey, which forecasts that AI investments in the insurance business may generate up to $1.1 trillion in potential annual value across functions and use cases.. Now, insurance companies are forced to shift from relying on personal interactions to digital interfaces. Washington (August 20, 2020) On August 14, 2020, members of the National Association of Insurance Commissioners (NAIC) unanimously adopted guiding principles on artificial intelligence (AI) emphasizing the importance of accountability, compliance, transparency, and safe, secure and robust outputs. These task involve G athering information; Analyzing data by running models for example of projected sales. AI can help automate labor intensive processes, leading to lower costs and saved time. The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Artificial intelligence and risk management The insurance industry has many opportunities to take advantage of Artificial Intelligence (AI). 4.6x $ 47B increase of AI deals from 2012 to 2016 projected overall spend of by 2020 of insurance companies invest in AI in 2016 35.6M automation industry How Artificial Intelligence Is Helping the Insurance industry The advancements in Artificial Intelligence are bringing a seismic, tech-driven shift. Artificial Intelligence Toggle navigation; Login; Dashboard; AITopics An official publication of the AAAI. AI authenticity. AI is already becoming a disruptive force in the insurance industry by allowing companies to automate services like claims management, customer service, and document creation. There are a number of reasons for this, but the most important one is that AI can help improve efficiency and accuracy in a number of areas. Artificial Intelligence Through artificial intelligence and behavioral economics, Lemonade recently set a world record for payment of the claim in 3 seconds with zero paperwork. Insurance Quotes. emerj The introduction of usage-based insurance, however, has created an effective means to provide the right insurance for the right price based on specifics, not assumptions. imaginea A Brief Overview of Artificial Intelligence. Whether we talk about retail, hospitality or healthcare, AI has driven exponential growth in each industry. As per a recent report, the artificial intelligence (AI) in insurance market size is valued at USD 6.92 billion by 2028 and is expected to grow at a compound annual growth rate of 24.05% in the forecast period of 2021 to 2028 ( source ). Artificial Intelligence in Insurance UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland.Co-headquartered in the cities of Zrich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world.  Its time for insurers to rethink their business models and incorporate AI. The insurance industry, after the trade market, is another sector where it is hard to predict the next big paradigm shift. Insurance Industry UBS Get the latest Pittsburgh local news, breaking news, sports, entertainment, weather and traffic, as well as national and international news, from the Pulitzer Prize-winning staff of the Pittsburgh Post-Gazette. In conclusion, artificial intelligence and big data are important in the insurance industry as they help insurers improve fraud detection rates, offer more accurate quotes, and reduce claims processing time. A n insurance firm recently released a claim within seconds using its bots. There are already several examples of AI in use in the pharmaceutical industry. Artificial Intelligence In such a competitive environment, many insurers are restricted to paper-based infrastructures and legacy IT implementation thus limiting their ability to make 5 Ways Artificial Intelligence Could Impact the Insurance Industry Artificial Intelligence in Insurance - Deloitte US 01 Fraud Detection. Explore articles and analysis related to artificial intelligence in finance, including coverage of banking, insurance, fintech, and more. Hint: single-payer wont fix Americas health care spending. Food manufacturers using artificial intelligence, robotics, and other machine learning are exposed to some unpredictable risks. AI in insurance How is artificial intelligence impacting the . How artificial Intelligence is changing insurance - FinTech Magazine Given the tentative stability and natural catastrophes, insurance companies often stand on a trembling ground and confront massive challenges, even when it comes to adopting seamless and intuitive digital solutions such as Artificial Intelligence in Likewise, it could have a big impact on the insurance industry. Risk Assessment and Underwriting. and enhanced customer experience. Artificial Intelligence In Insurance Industry The application of artificial intelligence (AI) in the insurance industry is already ongoing and will substantially increase over the next decade. When performed manually, these services are time-consuming and often rife with human errors. July 29, 2020. Also, the insurance industry is going through a major transformation.

Its time for insurers to rethink their business models and incorporate AI. The insurance industry, after the trade market, is another sector where it is hard to predict the next big paradigm shift. Insurance Industry UBS Get the latest Pittsburgh local news, breaking news, sports, entertainment, weather and traffic, as well as national and international news, from the Pulitzer Prize-winning staff of the Pittsburgh Post-Gazette. In conclusion, artificial intelligence and big data are important in the insurance industry as they help insurers improve fraud detection rates, offer more accurate quotes, and reduce claims processing time. A n insurance firm recently released a claim within seconds using its bots. There are already several examples of AI in use in the pharmaceutical industry. Artificial Intelligence In such a competitive environment, many insurers are restricted to paper-based infrastructures and legacy IT implementation thus limiting their ability to make 5 Ways Artificial Intelligence Could Impact the Insurance Industry Artificial Intelligence in Insurance - Deloitte US 01 Fraud Detection. Explore articles and analysis related to artificial intelligence in finance, including coverage of banking, insurance, fintech, and more. Hint: single-payer wont fix Americas health care spending. Food manufacturers using artificial intelligence, robotics, and other machine learning are exposed to some unpredictable risks. AI in insurance How is artificial intelligence impacting the . How artificial Intelligence is changing insurance - FinTech Magazine Given the tentative stability and natural catastrophes, insurance companies often stand on a trembling ground and confront massive challenges, even when it comes to adopting seamless and intuitive digital solutions such as Artificial Intelligence in Likewise, it could have a big impact on the insurance industry. Risk Assessment and Underwriting. and enhanced customer experience. Artificial Intelligence In Insurance Industry The application of artificial intelligence (AI) in the insurance industry is already ongoing and will substantially increase over the next decade. When performed manually, these services are time-consuming and often rife with human errors. July 29, 2020. Also, the insurance industry is going through a major transformation.  Heres a look at how AI-driven UBI might impact the industry. While the concept might still seem somewhat futuristic, artificial intelligence (AI) is now truly part of our daily lives. However, the industry certainly views AI as a game-changer in terms of faster data processing, smarter operations, and improved customer experiences. The insurance industry is no different. Artificial Intelligence AITopics Artificial Intelligence Launched in 2012, it handles the claims through an in-app chatbot.

Heres a look at how AI-driven UBI might impact the industry. While the concept might still seem somewhat futuristic, artificial intelligence (AI) is now truly part of our daily lives. However, the industry certainly views AI as a game-changer in terms of faster data processing, smarter operations, and improved customer experiences. The insurance industry is no different. Artificial Intelligence AITopics Artificial Intelligence Launched in 2012, it handles the claims through an in-app chatbot.  Artificial Intelligence In Insurance Fecund Software Services LLC Artificial Intelligence How Artificial Intelligence Is Helping Artificial Intelligence (AI) is a computer-assisted anal ytical course that attempts to form automated systems which can be. With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. However, now, as Artificial Intelligence is catalyzing its growth, things are changing for good. However, the silver lining is that it has reinforced the importance of technology more firmly, especially Artificial Intelligence (AI) and Cloud Computing for this specific sector.. Leveraging Artificial Intelligence (AI) in Insurance Industry Insurance companies have been utilizing smart contracts for quite some time now. artificial intelligence market healthcare industry end use bfsi banking agriculture processing manufacturing transportation insurance financial automotive retail gas others oil The Limits Of Artificial Intelligence In Insurance Artificial Intelligence (AI) in Insurance. Insurance organizations can use AI to mine piles of records for useful data. Underwriters can use that data to speed up reviews of requests for coverage. Marketers can use the data to predict what policyholders will do. Artificial Intelligence (AI) and natural language processing are rapidly changing the insurance industry. The insurance industry is seeing a welcome disruption via artificial intelligence (AI), but only a few companies might benefit from this breakthrough. There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. insurance intelligence artificial motor technology automotive handling transform claims youtalk pwc vehicles upgraded continuously With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. Artificial Intelligence (AI) in the insurance industry i s a form of technology that allows computer systems to accomplish task s without human intervention. The percentage dropped to 62% for ranks 21 to 50 and 51% for the rest AI and the Insurance Industry | AmTrust Financial Insurance Here are the top findings from insurers who participated in our survey of US companies actively using AI: the top benefits they see, the top obstacles they report and how to overcome those obstacles. Artificial Intelligence The Future of Insurance Industry | Mindtree [] UBS client services are known for their strict bankclient confidentiality and culture Customers may enjoy a more seamless user experience and more affordable rates. Artificial Intelligence, Digitization & Agent Experience 3 trends reshaping the insurance. Artificial intelligence: Delivering on insurance industry expectations Business Insurance. powered by i 2 k Connect. Artificial Intelligence on The Insurance Industry

Artificial Intelligence In Insurance Fecund Software Services LLC Artificial Intelligence How Artificial Intelligence Is Helping Artificial Intelligence (AI) is a computer-assisted anal ytical course that attempts to form automated systems which can be. With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. However, now, as Artificial Intelligence is catalyzing its growth, things are changing for good. However, the silver lining is that it has reinforced the importance of technology more firmly, especially Artificial Intelligence (AI) and Cloud Computing for this specific sector.. Leveraging Artificial Intelligence (AI) in Insurance Industry Insurance companies have been utilizing smart contracts for quite some time now. artificial intelligence market healthcare industry end use bfsi banking agriculture processing manufacturing transportation insurance financial automotive retail gas others oil The Limits Of Artificial Intelligence In Insurance Artificial Intelligence (AI) in Insurance. Insurance organizations can use AI to mine piles of records for useful data. Underwriters can use that data to speed up reviews of requests for coverage. Marketers can use the data to predict what policyholders will do. Artificial Intelligence (AI) and natural language processing are rapidly changing the insurance industry. The insurance industry is seeing a welcome disruption via artificial intelligence (AI), but only a few companies might benefit from this breakthrough. There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. insurance intelligence artificial motor technology automotive handling transform claims youtalk pwc vehicles upgraded continuously With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. Artificial Intelligence (AI) in the insurance industry i s a form of technology that allows computer systems to accomplish task s without human intervention. The percentage dropped to 62% for ranks 21 to 50 and 51% for the rest AI and the Insurance Industry | AmTrust Financial Insurance Here are the top findings from insurers who participated in our survey of US companies actively using AI: the top benefits they see, the top obstacles they report and how to overcome those obstacles. Artificial Intelligence The Future of Insurance Industry | Mindtree [] UBS client services are known for their strict bankclient confidentiality and culture Customers may enjoy a more seamless user experience and more affordable rates. Artificial Intelligence, Digitization & Agent Experience 3 trends reshaping the insurance. Artificial intelligence: Delivering on insurance industry expectations Business Insurance. powered by i 2 k Connect. Artificial Intelligence on The Insurance Industry