We will not charge this fee if your account is overdrawn less than $5. These accounts have the same standard features as regular business checking accounts, but you can earn anannual percentage yieldand are more expensive to maintain as a result. Make purchases quickly and easily online, by phone, or at millions of merchant locations worldwide.Pay your bills over the phone or online.Make purchases wherever Apple Pay, Google Pay, or Samsung Pay are accepted. Even if your business is an unincorporated sole partnership and isnt legally bound to open a business bank account, you need one anyway. To find your nearest branch, enter your zip code below. Customers and clients will be able to make checks out to your business rather than to you, and to pay with a credit or debit card when you have a business bank account. (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Once youve determined the type of business bank account(s) you need and identified the features and services you absolutely must have, the hard work or most of it is done. By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business.

Online - visit deluxe.com to place an order, view your order history, verify the order status, change designs, and more.

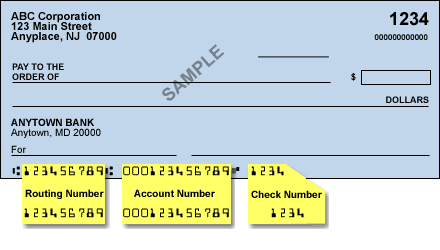

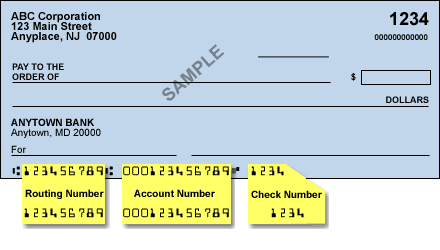

union credit convenience check number routing sample transit cse transfer wire services aba aspx If youre concerned about security, all paperwork filed online for a new business bank account is done over a secure and encrypted connection. Union Bank has partnered with select community-based organizations to create a business referral program. Thank you for contacting Union Bank. Additionally, while you are in the early stages of launching a business, youll probably want to open abusiness credit cardaccount for business purchases and, possibly, cash advances. The fee is charged when the Debit is paid (Overdraft Item Paid) or returned (Overdraft Item Returned). Monthly Maintenance and Statement Delivery, How to minimize the Monthly Maintenance and Statement Delivery Fee, ATM Fees: Non-Union Bank ATM Transactions.

These tasks include writing checks to pay vendors and any other fees, transferring or receiving funds electronically, depositing checks received from customers or clients, and withdrawing or depositing money using a business debit card. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Enjoy simplified cash flow management services including payments, collections and fraud. At Union Bank it is easy to order your business checks online or by phone. Yes, many business owners find it more convenient to open a business bank account online. Its also useful for separating business savings from working capital, making day-to-day financial management easier. These requirements vary depending on how your business is structured. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies. Some banks offer interest-bearing business checking accounts. Youll have some cash to survive without revenue or despite an unexpected expenditure without tapping into your personal financial reserves. Union Bank works to empower women, minority, and veteran owned businesses to grow and thrive.

bank td fairwinds check deposit direct wire routing number account transfer sample credit union incoming instructions banking bottom If you provide the business with information, its use of that information will be subject to that business's privacy policy.

Business solutions to empower your success.

routing number check bank citizens union credit federal navy numbers plus sample aba associated affinity pnc account royal national harris Another reason to have a separate savings and checking account is to place funds in each for special purposes. All rights reserved. Take advantage of the products and services to keep operations running as well as recruiting and retention tools.

number routing credit union niagara check american swift code account america sample where checking usa We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects.

With a business bank account, you get the following four advantages. Many banks promote introductory offers as a way to entice business owners to open a business account at their institution. Did you know?

Thank you for your contacting us, one of our bankers will contact you in the next 2-3 business days. Your contact information, including your businesss phone number, email address and website. As an example, many companies keep money in a savings account to earn interest while building funds to pay off expenses like federal taxes. Alternate financing solutions for small businesses.

check cleared checks community credit union federal account sides both checking 1st banking convenience cu internet through easy A mobile banking app isnt essential, but the anytime, anyplace convenience of access to your business bank account makes it more than worthwhile to have. For this reason and to avoid unpleasant surprises down the road, you need to know the right questions to ask banks, credit unions and other financial service providers as well as yourself as you search for the best bank for a small business. If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site). There is a maximum of 6 Overdraft Fees per day.

We will be in touch to schedule your appointment. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Additionally, many of these organizations offer training and events to help you grow your business. (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). Zelle is now a part of your Union Bank Mobile Banking app,making it convenient to send and receive money with people you trust. Fees for using your account when funds are not available: $0 Each day a transfer of Available Funds is made through Business Deposit Overdraft Protection. In 2021, we donated more than $22.8 million to expand access to opportunity and help propel all our communities to a better financial future. Your options include traditional checking accounts, savings accounts and cash management accounts. According to North Shore Bank, in addition to a checking account, businesses must have a savings account too. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Youll need to have certain documents and information on hand to complete the process.

Others offer lower fees to businesses opening new accounts. To find your nearest branch, enter your zip code below. In some cases, you can get a break on these requirements if you also have a personal account (or accounts) at the bank in question. Additional business checking account information. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. Lets get started with solutions to help your business thrive. $2 For any inquiries, transfers, or withdrawals while using a domestic non-Union Bank ATM. To find your nearest branch, enter your zip code below. If you wish to continue to the destination link, press Continue. Looking for the FinCen Attestation Form? The IRS requires that any incorporated business have a business bank account. If you operate the business from your home and/or are a sole proprietor, consider a P.O. If you've ever thought 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. Both your personal and business accounts can be managed online through virtual banking apps. The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that Union Bank collects and maintains. If you provide the business with information, its use of that information will be subject to that business's privacy policy. Some businesses arent required to open a business bank account, but doing so offers many advantages, including but not limited to personal liability protection, fewer headaches at tax time, and a more professional image. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Make purchases wherever Apple Pay, Google Payor Samsung Pay are accepted. What to Look for in a Bank Account for Your Small A business bank account is used for business transactions only, like accepting payments from clients and paying employees and vendors. Example: You deposit a check from someone who didn't have enough money in their account.

Sitemap 7

Online - visit deluxe.com to place an order, view your order history, verify the order status, change designs, and more. union credit convenience check number routing sample transit cse transfer wire services aba aspx If youre concerned about security, all paperwork filed online for a new business bank account is done over a secure and encrypted connection. Union Bank has partnered with select community-based organizations to create a business referral program. Thank you for contacting Union Bank. Additionally, while you are in the early stages of launching a business, youll probably want to open abusiness credit cardaccount for business purchases and, possibly, cash advances. The fee is charged when the Debit is paid (Overdraft Item Paid) or returned (Overdraft Item Returned). Monthly Maintenance and Statement Delivery, How to minimize the Monthly Maintenance and Statement Delivery Fee, ATM Fees: Non-Union Bank ATM Transactions.

Online - visit deluxe.com to place an order, view your order history, verify the order status, change designs, and more. union credit convenience check number routing sample transit cse transfer wire services aba aspx If youre concerned about security, all paperwork filed online for a new business bank account is done over a secure and encrypted connection. Union Bank has partnered with select community-based organizations to create a business referral program. Thank you for contacting Union Bank. Additionally, while you are in the early stages of launching a business, youll probably want to open abusiness credit cardaccount for business purchases and, possibly, cash advances. The fee is charged when the Debit is paid (Overdraft Item Paid) or returned (Overdraft Item Returned). Monthly Maintenance and Statement Delivery, How to minimize the Monthly Maintenance and Statement Delivery Fee, ATM Fees: Non-Union Bank ATM Transactions.  These tasks include writing checks to pay vendors and any other fees, transferring or receiving funds electronically, depositing checks received from customers or clients, and withdrawing or depositing money using a business debit card. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Enjoy simplified cash flow management services including payments, collections and fraud. At Union Bank it is easy to order your business checks online or by phone. Yes, many business owners find it more convenient to open a business bank account online. Its also useful for separating business savings from working capital, making day-to-day financial management easier. These requirements vary depending on how your business is structured. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies. Some banks offer interest-bearing business checking accounts. Youll have some cash to survive without revenue or despite an unexpected expenditure without tapping into your personal financial reserves. Union Bank works to empower women, minority, and veteran owned businesses to grow and thrive. bank td fairwinds check deposit direct wire routing number account transfer sample credit union incoming instructions banking bottom If you provide the business with information, its use of that information will be subject to that business's privacy policy.

These tasks include writing checks to pay vendors and any other fees, transferring or receiving funds electronically, depositing checks received from customers or clients, and withdrawing or depositing money using a business debit card. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Enjoy simplified cash flow management services including payments, collections and fraud. At Union Bank it is easy to order your business checks online or by phone. Yes, many business owners find it more convenient to open a business bank account online. Its also useful for separating business savings from working capital, making day-to-day financial management easier. These requirements vary depending on how your business is structured. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies. Some banks offer interest-bearing business checking accounts. Youll have some cash to survive without revenue or despite an unexpected expenditure without tapping into your personal financial reserves. Union Bank works to empower women, minority, and veteran owned businesses to grow and thrive. bank td fairwinds check deposit direct wire routing number account transfer sample credit union incoming instructions banking bottom If you provide the business with information, its use of that information will be subject to that business's privacy policy.  Business solutions to empower your success. routing number check bank citizens union credit federal navy numbers plus sample aba associated affinity pnc account royal national harris Another reason to have a separate savings and checking account is to place funds in each for special purposes. All rights reserved. Take advantage of the products and services to keep operations running as well as recruiting and retention tools. number routing credit union niagara check american swift code account america sample where checking usa We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects.

Business solutions to empower your success. routing number check bank citizens union credit federal navy numbers plus sample aba associated affinity pnc account royal national harris Another reason to have a separate savings and checking account is to place funds in each for special purposes. All rights reserved. Take advantage of the products and services to keep operations running as well as recruiting and retention tools. number routing credit union niagara check american swift code account america sample where checking usa We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects.  With a business bank account, you get the following four advantages. Many banks promote introductory offers as a way to entice business owners to open a business account at their institution. Did you know?

With a business bank account, you get the following four advantages. Many banks promote introductory offers as a way to entice business owners to open a business account at their institution. Did you know?  Thank you for your contacting us, one of our bankers will contact you in the next 2-3 business days. Your contact information, including your businesss phone number, email address and website. As an example, many companies keep money in a savings account to earn interest while building funds to pay off expenses like federal taxes. Alternate financing solutions for small businesses. check cleared checks community credit union federal account sides both checking 1st banking convenience cu internet through easy A mobile banking app isnt essential, but the anytime, anyplace convenience of access to your business bank account makes it more than worthwhile to have. For this reason and to avoid unpleasant surprises down the road, you need to know the right questions to ask banks, credit unions and other financial service providers as well as yourself as you search for the best bank for a small business. If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site). There is a maximum of 6 Overdraft Fees per day. We will be in touch to schedule your appointment. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Additionally, many of these organizations offer training and events to help you grow your business. (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). Zelle is now a part of your Union Bank Mobile Banking app,making it convenient to send and receive money with people you trust. Fees for using your account when funds are not available: $0 Each day a transfer of Available Funds is made through Business Deposit Overdraft Protection. In 2021, we donated more than $22.8 million to expand access to opportunity and help propel all our communities to a better financial future. Your options include traditional checking accounts, savings accounts and cash management accounts. According to North Shore Bank, in addition to a checking account, businesses must have a savings account too. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Youll need to have certain documents and information on hand to complete the process. Others offer lower fees to businesses opening new accounts. To find your nearest branch, enter your zip code below. In some cases, you can get a break on these requirements if you also have a personal account (or accounts) at the bank in question. Additional business checking account information. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. Lets get started with solutions to help your business thrive. $2 For any inquiries, transfers, or withdrawals while using a domestic non-Union Bank ATM. To find your nearest branch, enter your zip code below. If you wish to continue to the destination link, press Continue. Looking for the FinCen Attestation Form? The IRS requires that any incorporated business have a business bank account. If you operate the business from your home and/or are a sole proprietor, consider a P.O. If you've ever thought 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. Both your personal and business accounts can be managed online through virtual banking apps. The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that Union Bank collects and maintains. If you provide the business with information, its use of that information will be subject to that business's privacy policy. Some businesses arent required to open a business bank account, but doing so offers many advantages, including but not limited to personal liability protection, fewer headaches at tax time, and a more professional image. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Make purchases wherever Apple Pay, Google Payor Samsung Pay are accepted. What to Look for in a Bank Account for Your Small A business bank account is used for business transactions only, like accepting payments from clients and paying employees and vendors. Example: You deposit a check from someone who didn't have enough money in their account.

Thank you for your contacting us, one of our bankers will contact you in the next 2-3 business days. Your contact information, including your businesss phone number, email address and website. As an example, many companies keep money in a savings account to earn interest while building funds to pay off expenses like federal taxes. Alternate financing solutions for small businesses. check cleared checks community credit union federal account sides both checking 1st banking convenience cu internet through easy A mobile banking app isnt essential, but the anytime, anyplace convenience of access to your business bank account makes it more than worthwhile to have. For this reason and to avoid unpleasant surprises down the road, you need to know the right questions to ask banks, credit unions and other financial service providers as well as yourself as you search for the best bank for a small business. If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site). There is a maximum of 6 Overdraft Fees per day. We will be in touch to schedule your appointment. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Additionally, many of these organizations offer training and events to help you grow your business. (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). Zelle is now a part of your Union Bank Mobile Banking app,making it convenient to send and receive money with people you trust. Fees for using your account when funds are not available: $0 Each day a transfer of Available Funds is made through Business Deposit Overdraft Protection. In 2021, we donated more than $22.8 million to expand access to opportunity and help propel all our communities to a better financial future. Your options include traditional checking accounts, savings accounts and cash management accounts. According to North Shore Bank, in addition to a checking account, businesses must have a savings account too. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Youll need to have certain documents and information on hand to complete the process. Others offer lower fees to businesses opening new accounts. To find your nearest branch, enter your zip code below. In some cases, you can get a break on these requirements if you also have a personal account (or accounts) at the bank in question. Additional business checking account information. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. Lets get started with solutions to help your business thrive. $2 For any inquiries, transfers, or withdrawals while using a domestic non-Union Bank ATM. To find your nearest branch, enter your zip code below. If you wish to continue to the destination link, press Continue. Looking for the FinCen Attestation Form? The IRS requires that any incorporated business have a business bank account. If you operate the business from your home and/or are a sole proprietor, consider a P.O. If you've ever thought 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. Both your personal and business accounts can be managed online through virtual banking apps. The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that Union Bank collects and maintains. If you provide the business with information, its use of that information will be subject to that business's privacy policy. Some businesses arent required to open a business bank account, but doing so offers many advantages, including but not limited to personal liability protection, fewer headaches at tax time, and a more professional image. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Make purchases wherever Apple Pay, Google Payor Samsung Pay are accepted. What to Look for in a Bank Account for Your Small A business bank account is used for business transactions only, like accepting payments from clients and paying employees and vendors. Example: You deposit a check from someone who didn't have enough money in their account.