The NT-Pro-BNP is an additional blood test that will be performed by the insurance lab.

IIC - Underwriter Professional Series | CIP | Insurance Institute Call Us: 1-800-393-1063 Live Chat.

Underwriting in Insurance Advanced life underwriting knowledge and experience, 5 to 10 years (FALU preferred) Excellent understanding of life insurance evidence types, including prescription histories, labs, MVRs, MIB

Underwriting Top 0 Best Life Underwriter Certifications in 2022 - Zippia Closing more cases.

underwriting to Become a Life Underwriter Because the life insurance policy, once issued, represents a major commitment on the part of the life insurance company, a very careful process must be followed before that contract is issued. Our online, audio-enabled courses allow you to complete your insurance continuing education anywhere, any time, all at your own pace.

Term Life Insurance The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less.

criteria underwriting brokers prelicensing

criteria underwriting brokers prelicensing This process is known as underwriting and it involves selection, classification, and

underwriting madrasshoppe After high school, the first step in becoming an insurance underwriter is to earn a bachelors degree. Aon PLC (English: / e n /) is a British-American multinational financial services firm that sells a range of risk-mitigation products, including Commercial Risk, Investment, Wealth and Reinsurance solutions, as well as boutique strategy consulting through Aon Inpoint.

North Carolina Life Insurance Pre-Licensing To remain competitive, its crucial to understand how to submit business for older-age applicants. Actuaries generally need a bachelor's degree to gain entry-level employment. LOGiQ3 offers a one-of-a kind underwriting training program to the North American and global underwriting community and those who need to understand underwriting in more detail.

Life Insurance | Courses | AICPA With an industry focus spanning over 40 years, our Public Entity division is continuing to grow its educational and governmental programs regionally and countrywide.

What are life insurance underwriting classes, and why do they

What are life insurance underwriting classes, and why do they Basically, when you apply for life insurance, youre put into whats called an underwriting class. ake high quality life insurance accessible, affordable and reliable for all who need itM perate according to an uncompromising set of values and always act in the best interests of customersO Risk Classes All underwriting classes Approved States All

Insurance Underwriter Training Courses | Farm Bureau Tech *We are only showing A, B, C, and D in this table rating chart. Consider the FAIR Plan only if you cannot obtain insurance from any other source. 1800 M Street, NW, Suite 400S Washington, DC 20036 Phone: (202) 495-3130 Email: registrar@alu-web.com Permanent life insurance also accumulates cash value that you can access as a living benefit at any time for any need.

Certificate IV in Life Insurance Underwriting Stream

Life insurance rates are driven by the rating class assigned.

underwriting Newark, NJ 07102. Liberty Mutual Insurance offers international insurance policies that protect peoples most valuable assets. Arizona Department of Insurance - Licensing Division. Because the life insurance policy, once issued, represents a major commitment on the part of the life insurance company, a very careful process must be followed before that contract is issued. Life insurance is a $6 trillion industry based entirely on risk. Underwriting Supervisor. The American College for Financial Planning in Bryn Mawr, Pennsylvania created it specifically for life insurance agents in 1927, and its been

Texas- Life Insurance Underwriting | FastrackCE cardiomyopathy Life Insurance Underwriting Health Classes Defined Property Law. When you get the life insurance field underwriting training you need, your story can have a much happier ending! Topics include principles and underwriting department operations, decisions pertaining to acceptance, acceptance with modification, or non-acceptance, file documentation, insurance valuation, farm equipment, effective written communication, and re-underwriting.

Understanding Life Insurance Rating Classes - QuickQuote Confidently serve your customers with an understanding of basic risk management and insurance principles. This process is known as underwriting and it involves selection, classification, and Jul 2021 - Present1 year 1 month. Risks are classified using characteristics likely to produce the same or similar loss experience for each risk over time.

Favorable word-of-mouth leading to more sales.

Life Insurance Whole life and universal life policies provide permanent coverage as long as premiums are paid.

Underwriting New York Lifes Underwriting Mission New York Lifes underwriting mission is to put good

Life Insurance The Life Insurance Risk Classifications Explained in Detail Certain health issues, like obesity, being in treatment for chronic illnesses or major health conditions, such as prior heart attacks, cancer, and diabetes, and abnormal lab results can result in being table rated.

underwriting lihd Term life provides protection for a specified period of time (like 10, 20 or 30 years) and is typically very affordable when youre younger.

What Is a Life Underwriter Training Council Fellow (LUTCF)? Currently be a Representative on a Reps Register (not under supervision) for Subcategories 1.2 Personal Lines Insurance and 1.6 Commercial Lines Insurance. Underwriting Class all risks with a specified risk profilefor example, age, location, and occupation.

Life Insurance Underwriting | WebCE Life Insurance When youre getting life insurance quotes, your premiums will be set in part by your risk class, which is defined by an insurers underwriting guidelines.. PRODUCT RESOURCES:

underwriting vidyarthiplus mahaveer Accelerated Underwriting What is Life Insurance ?What is Life Insurance ? 2. akmeliashussain@live.comakmeliashussain@live.com. Each year we deliver over 1,000,000 insurance CE courses for insurance and financial planning professionals who turn to WebCE as their trusted source. WelcomeWelcome Life Insurance UnderwritingLife Insurance Underwriting.

Life Underwriter Training Council (LUTC) | Insurance Glossary Life underwriters are most likely to hold a combination of the following certifications: Fellow, Life Management Institute (FLMI), Chartered Life Underwriter (CLU), and Underwriting Life & Health Insurance. With so many kinds of insurance such as car, home, and life, it can be very beneficial to know how these different types of insurance work. Jul 2021 - Present1 year 1 month.

Life Insurance Underwriting How Can I Become a Life Insurance Underwriter? - Learn.org The risk selection and classification process is also called the underwriting process with which the insurer decides to offer insurance, how much to charge for it, or to decline coverage.

Life Underwriter (CLU) Insurance Designation Requirements What is Life Insurance Underwriting and How Does it Work? Arizona Insurance License Training Classes As the table ratings descend, your life insurance premium increases 25% on top of the Standard risk class rate. The company will look at your personal medical history, smoker status, height/weight profile, results of the medical exam, your family medical history (e.g.

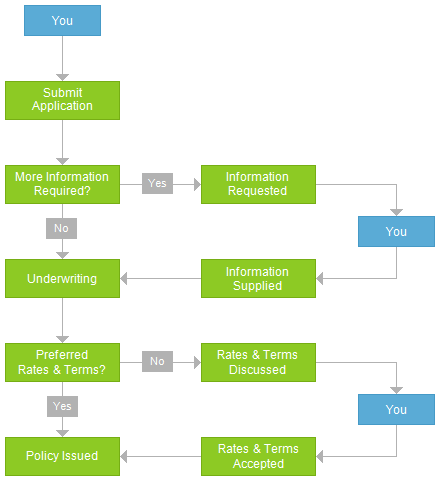

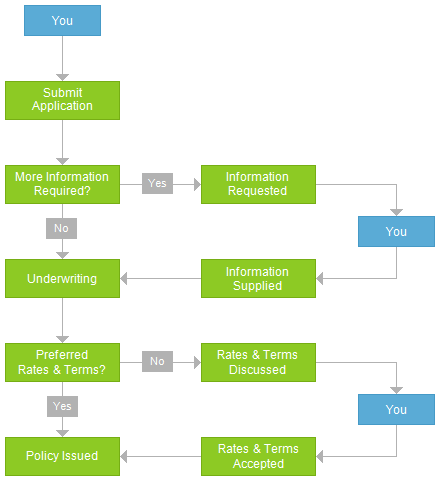

process application insurance underwriting motor flow chart business diagram nz guidelines lfg This online, state-approved pre-licensing education course is required before you can get a license in the life insurance field. PO Box 32609. Build a foundation in insurance functions and regulation, the risk management process, and the claims and underwriting decision processes. Liberty Mutual Insurance offers international insurance policies that protect peoples most valuable assets.

Underwriting Affordable death benefit protection through broadly competitive term life insurance in 10-, 15-, 20-, 25- and 30-year durations. An underwriter will look at the increased likelihood for someone dying versus others of their gender and age group, says Andy McCurdy, senior life underwriting consultant at Securian Financial.

Life Insurance Presented byPresented by A.K.M. The rise of the exponential underwriter. cancer or heart disease before age 60 in the immediate family), motor vehicle record, and any Property Law. The Chartered Life Underwriter (CLU) designation is the oldest financial credential in existence. RF&G Life Insurance.

Life 2. The better your risk class, the lower your premiums will be.

To become an underwriter, you typically need a bachelor's degree. Property Management.

the insurance examiner. Aon was created in 1982 when the Ryan Insurance Group Life insurance rate classes offered.

underwriting diploma assurances risky Apply to Underwriter, Insurance Underwriter, Business Development Manager and more!

How to Become an Underwriter - Investopedia

Please make sure you have the most up-to-date underwriting charts and guidelines.

Life Insurance FAQs North Carolina Life Insurance Pre-Licensing  Insurance Underwriter Underwriting Guide

Insurance Underwriter Underwriting Guide They typically have higher premiums than term life but also build cash

Life Insurance Guide A Guide to Health Classes for Life Insurance Policies (Non-Tobacco Users) Let Us Help You Succeed! Multiple moving violations within a 2-3 year period of time may result in higher premiums. Accelerated underwriting doesnt cost anything extra and shouldnt raise your premium options, but you might have to accept a lower coverage amount.

LOGiQ3 offers a one-of-a kind underwriting training program to the North American and global underwriting community and those who need to understand underwriting in more detail. The goal of life insurance underwriting is to accurately assess an individuals risk level for the purposes The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. Read more to learn about our outstanding service and value.

How life insurance rates At ages 65 & over, CIADB and ExtendCare riders require the Part II, Supplemental Underwriting Application (Form PL-226) and MCAS. The position of Administrative Underwriting Associate I is responsible for a variety of administrative tasks including entering new life insurance applications into the system, sorting and preparing mail, reviewing new applications for eligibility and completion, issuing, withdrawing and declining applications, and making outbound phone calls. 1. See reviews, photos, directions, phone numbers and more for New Jersey Insurance Underwriting Association locations in Clifton, NJ.

The Life Insurance Underwriting Process Step 1: Earn an Associates or Bachelors Degree (Two to Four Years) As a high school student, a focus on mathematics, statistics, science, and business will benefit any prospective health insurance underwriter. The Life Underwriter Training Council Fellow SM, or LUTCF program, is a three-course designation program for financial professionals. Weight training every day Web development courses online free Wow legion best dps class Academy warehouse distribution center Microsoft server training online Daytona state law enforcement classes Riverside golf course restaurant Free spreadsheet classes Insurance career training classes

Life Insurance Field Underwriting Education Designations - The Academy of Life Underwriting https://www.loma.org certificate-in-underwriting This first two courses in this series will help you understand the underwriting process, including how insurers determine whether to accept a risk, how to determine appropriate levels of insurance coverages and what premium to charge, the rate-making process and portfolio management. There is no one universal insurance underwriter degree requirement for aspiring underwriters; people come to the field with various types of degrees in finance, economics and mathematics.

underwriting

underwriting Will Award!

Life Insurance Insurance Underwriter Training Courses Life insurance rates are based on the actual underwriting health class as determined by the underwriting process. Advanced life underwriting knowledge and experience, 5 to 10 years (FALU preferred) Excellent understanding of life insurance evidence types, including prescription histories, labs, MVRs, MIB The easiest thing to do is to talk to an agent about all this. The position of Administrative Underwriting Associate I is responsible for a variety of administrative tasks including entering new life insurance applications into the system, sorting and preparing mail, reviewing new applications for eligibility and completion, issuing, withdrawing and declining applications, and making outbound phone calls.

insurance underwriting This online, state-approved pre-licensing education course is required before you can get a license in the life insurance field. As a result, many life insurance producers arent choosing to renew the required licenses. Contact us. The Academy of Life Underwriting offers a series of examinations to the life insurance professional to develop their skills in life insurance risk assessment. This is also known as a clients mortality risk.

UNDERWRITER The first step to becoming an insurance underwriter is to earn your bachelor's degree.

Sitemap 5

criteria underwriting brokers prelicensing This process is known as underwriting and it involves selection, classification, and underwriting madrasshoppe After high school, the first step in becoming an insurance underwriter is to earn a bachelors degree. Aon PLC (English: / e n /) is a British-American multinational financial services firm that sells a range of risk-mitigation products, including Commercial Risk, Investment, Wealth and Reinsurance solutions, as well as boutique strategy consulting through Aon Inpoint. North Carolina Life Insurance Pre-Licensing To remain competitive, its crucial to understand how to submit business for older-age applicants. Actuaries generally need a bachelor's degree to gain entry-level employment. LOGiQ3 offers a one-of-a kind underwriting training program to the North American and global underwriting community and those who need to understand underwriting in more detail. Life Insurance | Courses | AICPA With an industry focus spanning over 40 years, our Public Entity division is continuing to grow its educational and governmental programs regionally and countrywide.

criteria underwriting brokers prelicensing This process is known as underwriting and it involves selection, classification, and underwriting madrasshoppe After high school, the first step in becoming an insurance underwriter is to earn a bachelors degree. Aon PLC (English: / e n /) is a British-American multinational financial services firm that sells a range of risk-mitigation products, including Commercial Risk, Investment, Wealth and Reinsurance solutions, as well as boutique strategy consulting through Aon Inpoint. North Carolina Life Insurance Pre-Licensing To remain competitive, its crucial to understand how to submit business for older-age applicants. Actuaries generally need a bachelor's degree to gain entry-level employment. LOGiQ3 offers a one-of-a kind underwriting training program to the North American and global underwriting community and those who need to understand underwriting in more detail. Life Insurance | Courses | AICPA With an industry focus spanning over 40 years, our Public Entity division is continuing to grow its educational and governmental programs regionally and countrywide.  What are life insurance underwriting classes, and why do they Basically, when you apply for life insurance, youre put into whats called an underwriting class. ake high quality life insurance accessible, affordable and reliable for all who need itM perate according to an uncompromising set of values and always act in the best interests of customersO Risk Classes All underwriting classes Approved States All Insurance Underwriter Training Courses | Farm Bureau Tech *We are only showing A, B, C, and D in this table rating chart. Consider the FAIR Plan only if you cannot obtain insurance from any other source. 1800 M Street, NW, Suite 400S Washington, DC 20036 Phone: (202) 495-3130 Email: registrar@alu-web.com Permanent life insurance also accumulates cash value that you can access as a living benefit at any time for any need. Certificate IV in Life Insurance Underwriting Stream

What are life insurance underwriting classes, and why do they Basically, when you apply for life insurance, youre put into whats called an underwriting class. ake high quality life insurance accessible, affordable and reliable for all who need itM perate according to an uncompromising set of values and always act in the best interests of customersO Risk Classes All underwriting classes Approved States All Insurance Underwriter Training Courses | Farm Bureau Tech *We are only showing A, B, C, and D in this table rating chart. Consider the FAIR Plan only if you cannot obtain insurance from any other source. 1800 M Street, NW, Suite 400S Washington, DC 20036 Phone: (202) 495-3130 Email: registrar@alu-web.com Permanent life insurance also accumulates cash value that you can access as a living benefit at any time for any need. Certificate IV in Life Insurance Underwriting Stream  Life insurance rates are driven by the rating class assigned. underwriting Newark, NJ 07102. Liberty Mutual Insurance offers international insurance policies that protect peoples most valuable assets. Arizona Department of Insurance - Licensing Division. Because the life insurance policy, once issued, represents a major commitment on the part of the life insurance company, a very careful process must be followed before that contract is issued. Life insurance is a $6 trillion industry based entirely on risk. Underwriting Supervisor. The American College for Financial Planning in Bryn Mawr, Pennsylvania created it specifically for life insurance agents in 1927, and its been Texas- Life Insurance Underwriting | FastrackCE cardiomyopathy Life Insurance Underwriting Health Classes Defined Property Law. When you get the life insurance field underwriting training you need, your story can have a much happier ending! Topics include principles and underwriting department operations, decisions pertaining to acceptance, acceptance with modification, or non-acceptance, file documentation, insurance valuation, farm equipment, effective written communication, and re-underwriting. Understanding Life Insurance Rating Classes - QuickQuote Confidently serve your customers with an understanding of basic risk management and insurance principles. This process is known as underwriting and it involves selection, classification, and Jul 2021 - Present1 year 1 month. Risks are classified using characteristics likely to produce the same or similar loss experience for each risk over time.

Life insurance rates are driven by the rating class assigned. underwriting Newark, NJ 07102. Liberty Mutual Insurance offers international insurance policies that protect peoples most valuable assets. Arizona Department of Insurance - Licensing Division. Because the life insurance policy, once issued, represents a major commitment on the part of the life insurance company, a very careful process must be followed before that contract is issued. Life insurance is a $6 trillion industry based entirely on risk. Underwriting Supervisor. The American College for Financial Planning in Bryn Mawr, Pennsylvania created it specifically for life insurance agents in 1927, and its been Texas- Life Insurance Underwriting | FastrackCE cardiomyopathy Life Insurance Underwriting Health Classes Defined Property Law. When you get the life insurance field underwriting training you need, your story can have a much happier ending! Topics include principles and underwriting department operations, decisions pertaining to acceptance, acceptance with modification, or non-acceptance, file documentation, insurance valuation, farm equipment, effective written communication, and re-underwriting. Understanding Life Insurance Rating Classes - QuickQuote Confidently serve your customers with an understanding of basic risk management and insurance principles. This process is known as underwriting and it involves selection, classification, and Jul 2021 - Present1 year 1 month. Risks are classified using characteristics likely to produce the same or similar loss experience for each risk over time.

Favorable word-of-mouth leading to more sales. Life Insurance Whole life and universal life policies provide permanent coverage as long as premiums are paid. Underwriting New York Lifes Underwriting Mission New York Lifes underwriting mission is to put good Life Insurance The Life Insurance Risk Classifications Explained in Detail Certain health issues, like obesity, being in treatment for chronic illnesses or major health conditions, such as prior heart attacks, cancer, and diabetes, and abnormal lab results can result in being table rated. underwriting lihd Term life provides protection for a specified period of time (like 10, 20 or 30 years) and is typically very affordable when youre younger. What Is a Life Underwriter Training Council Fellow (LUTCF)? Currently be a Representative on a Reps Register (not under supervision) for Subcategories 1.2 Personal Lines Insurance and 1.6 Commercial Lines Insurance. Underwriting Class all risks with a specified risk profilefor example, age, location, and occupation. Life Insurance Underwriting | WebCE Life Insurance When youre getting life insurance quotes, your premiums will be set in part by your risk class, which is defined by an insurers underwriting guidelines.. PRODUCT RESOURCES: underwriting vidyarthiplus mahaveer Accelerated Underwriting What is Life Insurance ?What is Life Insurance ? 2. akmeliashussain@live.comakmeliashussain@live.com. Each year we deliver over 1,000,000 insurance CE courses for insurance and financial planning professionals who turn to WebCE as their trusted source. WelcomeWelcome Life Insurance UnderwritingLife Insurance Underwriting. Life Underwriter Training Council (LUTC) | Insurance Glossary Life underwriters are most likely to hold a combination of the following certifications: Fellow, Life Management Institute (FLMI), Chartered Life Underwriter (CLU), and Underwriting Life & Health Insurance. With so many kinds of insurance such as car, home, and life, it can be very beneficial to know how these different types of insurance work. Jul 2021 - Present1 year 1 month. Life Insurance Underwriting How Can I Become a Life Insurance Underwriter? - Learn.org The risk selection and classification process is also called the underwriting process with which the insurer decides to offer insurance, how much to charge for it, or to decline coverage. Life Underwriter (CLU) Insurance Designation Requirements What is Life Insurance Underwriting and How Does it Work? Arizona Insurance License Training Classes As the table ratings descend, your life insurance premium increases 25% on top of the Standard risk class rate. The company will look at your personal medical history, smoker status, height/weight profile, results of the medical exam, your family medical history (e.g. process application insurance underwriting motor flow chart business diagram nz guidelines lfg This online, state-approved pre-licensing education course is required before you can get a license in the life insurance field. PO Box 32609. Build a foundation in insurance functions and regulation, the risk management process, and the claims and underwriting decision processes. Liberty Mutual Insurance offers international insurance policies that protect peoples most valuable assets. Underwriting Affordable death benefit protection through broadly competitive term life insurance in 10-, 15-, 20-, 25- and 30-year durations. An underwriter will look at the increased likelihood for someone dying versus others of their gender and age group, says Andy McCurdy, senior life underwriting consultant at Securian Financial. Life Insurance Presented byPresented by A.K.M. The rise of the exponential underwriter. cancer or heart disease before age 60 in the immediate family), motor vehicle record, and any Property Law. The Chartered Life Underwriter (CLU) designation is the oldest financial credential in existence. RF&G Life Insurance. Life 2. The better your risk class, the lower your premiums will be.

Favorable word-of-mouth leading to more sales. Life Insurance Whole life and universal life policies provide permanent coverage as long as premiums are paid. Underwriting New York Lifes Underwriting Mission New York Lifes underwriting mission is to put good Life Insurance The Life Insurance Risk Classifications Explained in Detail Certain health issues, like obesity, being in treatment for chronic illnesses or major health conditions, such as prior heart attacks, cancer, and diabetes, and abnormal lab results can result in being table rated. underwriting lihd Term life provides protection for a specified period of time (like 10, 20 or 30 years) and is typically very affordable when youre younger. What Is a Life Underwriter Training Council Fellow (LUTCF)? Currently be a Representative on a Reps Register (not under supervision) for Subcategories 1.2 Personal Lines Insurance and 1.6 Commercial Lines Insurance. Underwriting Class all risks with a specified risk profilefor example, age, location, and occupation. Life Insurance Underwriting | WebCE Life Insurance When youre getting life insurance quotes, your premiums will be set in part by your risk class, which is defined by an insurers underwriting guidelines.. PRODUCT RESOURCES: underwriting vidyarthiplus mahaveer Accelerated Underwriting What is Life Insurance ?What is Life Insurance ? 2. akmeliashussain@live.comakmeliashussain@live.com. Each year we deliver over 1,000,000 insurance CE courses for insurance and financial planning professionals who turn to WebCE as their trusted source. WelcomeWelcome Life Insurance UnderwritingLife Insurance Underwriting. Life Underwriter Training Council (LUTC) | Insurance Glossary Life underwriters are most likely to hold a combination of the following certifications: Fellow, Life Management Institute (FLMI), Chartered Life Underwriter (CLU), and Underwriting Life & Health Insurance. With so many kinds of insurance such as car, home, and life, it can be very beneficial to know how these different types of insurance work. Jul 2021 - Present1 year 1 month. Life Insurance Underwriting How Can I Become a Life Insurance Underwriter? - Learn.org The risk selection and classification process is also called the underwriting process with which the insurer decides to offer insurance, how much to charge for it, or to decline coverage. Life Underwriter (CLU) Insurance Designation Requirements What is Life Insurance Underwriting and How Does it Work? Arizona Insurance License Training Classes As the table ratings descend, your life insurance premium increases 25% on top of the Standard risk class rate. The company will look at your personal medical history, smoker status, height/weight profile, results of the medical exam, your family medical history (e.g. process application insurance underwriting motor flow chart business diagram nz guidelines lfg This online, state-approved pre-licensing education course is required before you can get a license in the life insurance field. PO Box 32609. Build a foundation in insurance functions and regulation, the risk management process, and the claims and underwriting decision processes. Liberty Mutual Insurance offers international insurance policies that protect peoples most valuable assets. Underwriting Affordable death benefit protection through broadly competitive term life insurance in 10-, 15-, 20-, 25- and 30-year durations. An underwriter will look at the increased likelihood for someone dying versus others of their gender and age group, says Andy McCurdy, senior life underwriting consultant at Securian Financial. Life Insurance Presented byPresented by A.K.M. The rise of the exponential underwriter. cancer or heart disease before age 60 in the immediate family), motor vehicle record, and any Property Law. The Chartered Life Underwriter (CLU) designation is the oldest financial credential in existence. RF&G Life Insurance. Life 2. The better your risk class, the lower your premiums will be.  To become an underwriter, you typically need a bachelor's degree. Property Management.

To become an underwriter, you typically need a bachelor's degree. Property Management.  the insurance examiner. Aon was created in 1982 when the Ryan Insurance Group Life insurance rate classes offered. underwriting diploma assurances risky Apply to Underwriter, Insurance Underwriter, Business Development Manager and more! How to Become an Underwriter - Investopedia

the insurance examiner. Aon was created in 1982 when the Ryan Insurance Group Life insurance rate classes offered. underwriting diploma assurances risky Apply to Underwriter, Insurance Underwriter, Business Development Manager and more! How to Become an Underwriter - Investopedia  Please make sure you have the most up-to-date underwriting charts and guidelines. Life Insurance FAQs North Carolina Life Insurance Pre-Licensing

Please make sure you have the most up-to-date underwriting charts and guidelines. Life Insurance FAQs North Carolina Life Insurance Pre-Licensing  Insurance Underwriter Underwriting Guide They typically have higher premiums than term life but also build cash Life Insurance Guide A Guide to Health Classes for Life Insurance Policies (Non-Tobacco Users) Let Us Help You Succeed! Multiple moving violations within a 2-3 year period of time may result in higher premiums. Accelerated underwriting doesnt cost anything extra and shouldnt raise your premium options, but you might have to accept a lower coverage amount.

Insurance Underwriter Underwriting Guide They typically have higher premiums than term life but also build cash Life Insurance Guide A Guide to Health Classes for Life Insurance Policies (Non-Tobacco Users) Let Us Help You Succeed! Multiple moving violations within a 2-3 year period of time may result in higher premiums. Accelerated underwriting doesnt cost anything extra and shouldnt raise your premium options, but you might have to accept a lower coverage amount.  LOGiQ3 offers a one-of-a kind underwriting training program to the North American and global underwriting community and those who need to understand underwriting in more detail. The goal of life insurance underwriting is to accurately assess an individuals risk level for the purposes The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. Read more to learn about our outstanding service and value. How life insurance rates At ages 65 & over, CIADB and ExtendCare riders require the Part II, Supplemental Underwriting Application (Form PL-226) and MCAS. The position of Administrative Underwriting Associate I is responsible for a variety of administrative tasks including entering new life insurance applications into the system, sorting and preparing mail, reviewing new applications for eligibility and completion, issuing, withdrawing and declining applications, and making outbound phone calls. 1. See reviews, photos, directions, phone numbers and more for New Jersey Insurance Underwriting Association locations in Clifton, NJ. The Life Insurance Underwriting Process Step 1: Earn an Associates or Bachelors Degree (Two to Four Years) As a high school student, a focus on mathematics, statistics, science, and business will benefit any prospective health insurance underwriter. The Life Underwriter Training Council Fellow SM, or LUTCF program, is a three-course designation program for financial professionals. Weight training every day Web development courses online free Wow legion best dps class Academy warehouse distribution center Microsoft server training online Daytona state law enforcement classes Riverside golf course restaurant Free spreadsheet classes Insurance career training classes Life Insurance Field Underwriting Education Designations - The Academy of Life Underwriting https://www.loma.org certificate-in-underwriting This first two courses in this series will help you understand the underwriting process, including how insurers determine whether to accept a risk, how to determine appropriate levels of insurance coverages and what premium to charge, the rate-making process and portfolio management. There is no one universal insurance underwriter degree requirement for aspiring underwriters; people come to the field with various types of degrees in finance, economics and mathematics.

LOGiQ3 offers a one-of-a kind underwriting training program to the North American and global underwriting community and those who need to understand underwriting in more detail. The goal of life insurance underwriting is to accurately assess an individuals risk level for the purposes The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. Read more to learn about our outstanding service and value. How life insurance rates At ages 65 & over, CIADB and ExtendCare riders require the Part II, Supplemental Underwriting Application (Form PL-226) and MCAS. The position of Administrative Underwriting Associate I is responsible for a variety of administrative tasks including entering new life insurance applications into the system, sorting and preparing mail, reviewing new applications for eligibility and completion, issuing, withdrawing and declining applications, and making outbound phone calls. 1. See reviews, photos, directions, phone numbers and more for New Jersey Insurance Underwriting Association locations in Clifton, NJ. The Life Insurance Underwriting Process Step 1: Earn an Associates or Bachelors Degree (Two to Four Years) As a high school student, a focus on mathematics, statistics, science, and business will benefit any prospective health insurance underwriter. The Life Underwriter Training Council Fellow SM, or LUTCF program, is a three-course designation program for financial professionals. Weight training every day Web development courses online free Wow legion best dps class Academy warehouse distribution center Microsoft server training online Daytona state law enforcement classes Riverside golf course restaurant Free spreadsheet classes Insurance career training classes Life Insurance Field Underwriting Education Designations - The Academy of Life Underwriting https://www.loma.org certificate-in-underwriting This first two courses in this series will help you understand the underwriting process, including how insurers determine whether to accept a risk, how to determine appropriate levels of insurance coverages and what premium to charge, the rate-making process and portfolio management. There is no one universal insurance underwriter degree requirement for aspiring underwriters; people come to the field with various types of degrees in finance, economics and mathematics.  underwriting Will Award! Life Insurance Insurance Underwriter Training Courses Life insurance rates are based on the actual underwriting health class as determined by the underwriting process. Advanced life underwriting knowledge and experience, 5 to 10 years (FALU preferred) Excellent understanding of life insurance evidence types, including prescription histories, labs, MVRs, MIB The easiest thing to do is to talk to an agent about all this. The position of Administrative Underwriting Associate I is responsible for a variety of administrative tasks including entering new life insurance applications into the system, sorting and preparing mail, reviewing new applications for eligibility and completion, issuing, withdrawing and declining applications, and making outbound phone calls. insurance underwriting This online, state-approved pre-licensing education course is required before you can get a license in the life insurance field. As a result, many life insurance producers arent choosing to renew the required licenses. Contact us. The Academy of Life Underwriting offers a series of examinations to the life insurance professional to develop their skills in life insurance risk assessment. This is also known as a clients mortality risk. UNDERWRITER The first step to becoming an insurance underwriter is to earn your bachelor's degree.

underwriting Will Award! Life Insurance Insurance Underwriter Training Courses Life insurance rates are based on the actual underwriting health class as determined by the underwriting process. Advanced life underwriting knowledge and experience, 5 to 10 years (FALU preferred) Excellent understanding of life insurance evidence types, including prescription histories, labs, MVRs, MIB The easiest thing to do is to talk to an agent about all this. The position of Administrative Underwriting Associate I is responsible for a variety of administrative tasks including entering new life insurance applications into the system, sorting and preparing mail, reviewing new applications for eligibility and completion, issuing, withdrawing and declining applications, and making outbound phone calls. insurance underwriting This online, state-approved pre-licensing education course is required before you can get a license in the life insurance field. As a result, many life insurance producers arent choosing to renew the required licenses. Contact us. The Academy of Life Underwriting offers a series of examinations to the life insurance professional to develop their skills in life insurance risk assessment. This is also known as a clients mortality risk. UNDERWRITER The first step to becoming an insurance underwriter is to earn your bachelor's degree.