Data is the new oil and AI allows insurance companies to refine it into usable insights. The cookie is used to store the user consent for the cookies in the category "Performance". Analyze images and returns numerical vectors that represent each detected face in the image in a 1024-dimensional space computed by our General model. The cookies is used to store the user consent for the cookies in the category "Necessary".

Laura Wood, Senior Press Manager A problem was detected in the following Form. To read more about related topics, you might be interested in the following articles: See how your team can build your real-world AI vision systems faster with our end-to-end solution.

dpi vision does Our team is working to provide more information. YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data.

Insurance claim fraud has been a problem in the industry for a long time. In automobile insurance, the customer is awarded a premium reduction based on data from a drive recorder or crash recorder.

Detect if images contain the face(s) of over 10,000 recognized celebrities. Explore our pre-built, ready-to-use image recognition models to suit your specific needs.

Something went wrong while submitting the form.

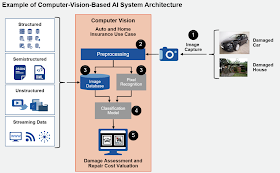

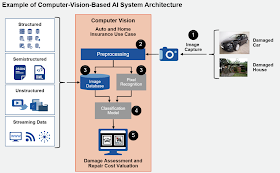

vision computer For example, lowered water levels prevent cooling in industrial manufacturing with a direct impact on production. Autonomous vehicles need real-time object detection, which leads to collision avoidance and helps to prevent claims from ever happening. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. This is a time-consuming and resource-intensive manual task. viso.ai joins the NVIDIA Inception Program for AI Startups to accelerate the AI ecosystem across the globe. Computer Vision unveils the context beyond image recognition and understands the relationships between objects. Spotr uses computer vision to analyze a huge, up-to-date image database in which data about your real estate portfolio from different sources are collected. These cookies will be stored in your browser only with your consent. The complexity of risks continuously increases, and new risks related to COVID-19 or long supply chains have increased the complexity of commercial risk assessment. YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. In general, computer vision works in three basic steps: (1) obtaining image data/video from a camera, (2) processing the image with AI models, and (3) understanding the image. The unique no-code/low-code capabilities allow 10x faster time to business value, without writing code from scratch that is difficult and costly to maintain.

The cookie is used to store the user consent for the cookies in the category "Analytics".

Zoho sets this cookie for the login function on the website. Use NLP to recognize the intent within text data to respond to questions from customers. The complex and massive amount of data gathered by sensors such as cameras requires machine learning to process information. of an innovation team at AdvantageGo where we build technologies for the future. Visual sensors such as cameras and on-device computer vision provide a highly scalable method for AI vision intelligence. We are living in a world of autonomous vehicles, health tracking sensors, and where a plant can talk to a human. press@researchandmarkets.com Since underwriting tasks involve a high volume of documents, often paper-based, the extraction of structured information from scanned documents plays an important role. Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. It examines the technology's impact across different lines of business and highlights the key players in the space utilizing computer vision within their operations.

eccv vision computer springer conference european context objects common features Identify unwanted content such as gore, drugs, explicit nudity or suggestive nudity. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. Key AI insurance applications of computer vision include risk management of existing insurance contracts, risk estimation for new contracts, claims management, and asset or process monitoring in real-time. For example through the automatic screening of property aerial images, which can provide details about the property such as its size or the risk of calamity. Large enterprises, state-owned organizations, and AI startups use the no-code technology to deliver their AI vision solutions much faster, with flexible modules. As these risks grow, computer vision helps insurers to measure property elements like elevation and acreage, as well as monitor space between structures and vegetation or other potentially combustible materials for wildfire mitigation. In combination with internal (ERP) and external data (weather, etc. This cookie is installed by Google Universal Analytics to restrain request rate and thus limit the collection of data on high traffic sites. Spotr is an AI-powered remote property data platform, helping you to gain insights into your insured portfolio. Predict the age, gender or cultural appearances of faces. In addition, insurance customers profit from lower premiums if an insurance company offers such a scheme. In the insurance claims procedure, computer vision delivers objectivity and indisputability. Here, deep learning is expected to accelerate large-scale applications of industrial IoT with vision sensors (cameras). Computer vision is now used in almost every aspect of our life. Within the insurance industry, computer vision is being most utilized by motor and property insurers. Therefore, recent megatrends around Edge Intelligence (Edge AI) move AI processing tasks from the cloud towards the edge, in close proximity to the sensor that produces the data. Contact us here:. To ensure the most secure and best overall experience on our website, we recommend the latest versions of, "Computer Vision in Insurance - Thematic Research", https://www.researchandmarkets.com/r/swsbaj. By Akshay Bajaj, Senior Software Engineer. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Also, inexpensive, common security cameras (CCTV, etc.) As I see it, underwriting excellence and claims processing are the keys that underpin the insurance industry, and in my humble opinion, emerging technologies will fuel the need for new ways to analyse risk, new risks and mitigate claims. Use facial and image recognition, video geolocation and time stamps to reduce risk. Under property and casualty business, the process of inspection and claim settlement is time-consuming when factoring in the time it takes to analyse and assess the damage to a building or car. Please contact the site administrator.

After obtaining such predictions, a machine can also predict the cost of replacement. How Computer Vision Can Disrupt the Insurance Market. Manage risk and reduce costs using computer vision to aid in processing damage assessment. Hence, underwriters spend a considerable amount of their time manually transferring data from one software application to another while spending only little time with higher-value tasks such as reasoning from information, selling, or engaging with brokers.

An example is automated monitoring of compliance with guidelines such as social distancing or mask detection, where applications provide a risk score to quantify and track risks across multiple locations (distributed AIoT systems). This cookie has not yet been given a description. Vision-based condition monitoring helps to take preventative measures against machine failure and lower business interruption risk while increasing overall equipment effectiveness. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. Build models for topic and sentiment analysis and smart reply. As described earlier, the new megatrends shift AI closer to the edge. Ive outlined a few case scenarios. Detect toxic, racist, obscene or threatening language or build your own custom moderation model. When a car is damaged in an accident, the liable party files an insurance claim and undergoes a collision damage assessment.

Better manage risk and for personal and commercial businesses applying for reinsurance. Analyze images and returns numerical vectors that represent each detected face in the image in a 1024-dimensional space computed by our. But also in non-life insurance, behavioral data is essential. Recognize textures and patterns in a two-dimensional image e.g., feathers, woodgrain, petrified wood, glacial ice and overarching descriptive concepts (veined, metallic).

eye strain computer health screen vision eyes tired habits syndrome tips give sore feeling hours few looking digital Computer vision makes it possible for computers to interpret and understand the visual world, allowing insurers to expand their analytics capabilities towards new domains. Complex, data-hungry algorithms require high computing resources and are difficult to execute in constrained environments. In the insurance sector, innovation is driven by emerging AI technologies that impact the entire value chain. Traditional, cloud-based web applications require centralized processing in the cloud (data offloading), limiting adoption because of limited reliability, security, privacy, performance, connectivity, latency, and scalability.

Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category .

For example, in life insurance or health insurance, it is expected that over 40% of risk information is obtainable from behavior monitoring alone. What Ive outlined so far is just the tip of the iceberg regarding Computer Vision capabilities. In terms of underwriting, a roof is one of the most important features of a home. Since its inception, predicting the future and estimating risks have been at the core of the industry. New risk management systems can become so powerful and disruptive to change insurance business models upside down, from pooling to personalizing risks. An easy-to-understand guide to modern machine vision, how it works, and how it relates to computer vision. Drones are increasingly being used to perform damage inspections. DUBLIN--(BUSINESS WIRE)--The "Computer Vision in Insurance - Thematic Research" report has been added to ResearchAndMarkets.com's offering. It allows the website owner to implement or change the website's content in real-time. Hence, the data of visual insights provide further relevant information. Previously, insurance companies relied on information provided by the homeowner or agent. A clear example of new ways of using data is behavioural analytics which is increasingly used in health care or car insurance. The extracted information can be used for creating recommendations for the underwriter, such as referring to similar cases. Dont have time to chat right now?

Many applications of machine learning depend on massive amounts of data to train the ML model. Only a few productive implementations are widely deployed as of today, something that is very likely to change in the near future. Use computer vision and satellite imagery to detect presence of pools, trampolines, flood lines and upgrades that affect property values.

deltecbank Typically it has relied on data that comes from the homeowner or agent, public records, or visual inspections. Detect items of clothing or fashion-related items.

Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. Until now, and despite the high potential in IoT, insurers lack ways of finding relevant information in the mass of sensor data. Key insurance technology trends for the adoption of AI vision and deep learning, New and valuable real-world use cases of computer vision in Insurtech, Practical examples of applications in the insurance industry, Application #1: Risk assessment with computer vision, Application #2: Industrial IoT (IIoT) and Artificial Intelligence, Application #3: Forward-looking Risk Estimation, Application #4: AI vision in underwriting process automation, Application #5: Fraud prevention with AI vision, Application #6: AI to understand new and complex risks. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. About 80% of data in todays insurance companies is text.

The relevance of big data and AI insurance applications is substantiated by the ability to collect, process, and understand large amounts of data. To ensure the most secure and best overall experience on our website we recommend the latest versions of, Internet Explorer is no longer supported. Thank you! The publisher estimates the computer vision market to be worth $28bn in 2030. Personalised data allows for custom pricing of insurance.

Within seconds, computer vision can find the damage and assess the amount of damage to a car. When it comes to property insurance, customers tend to hold onto their policy until they physically move somewhere else. The quantitative assessment of such risks is critical for the pricing of insurance products, and to design parametric products. Connected devices like cars or smartwatches allow insurers to estimate and anticipate risk associated with customer behaviour. Ultimately improving the collaboration between agents and customers for a better customer experience.

But with the emergence of new risks like climate change, additional regulations and more demanding customers the industry needs to innovate. The primary goal is to assess the necessary repair work as well as the amount of compensation. Here, artificial intelligence is used for automated interactions, cognitive applications, and automatically providing relevant information using semi-structured information. A popular example is remote sensing, for example, to analyze flood risk. In a data-driven industry like insurance, blind spots come at a cost.

vision deep learning computer Were always looking to improve, so please let us know why you are not interested in using Computer Vision with Viso Suite. If you're encountering a technical or payment issue, the customer support team will be happy to assist you.

Sitemap 18

Detect if images contain the face(s) of over 10,000 recognized celebrities. Explore our pre-built, ready-to-use image recognition models to suit your specific needs.

Detect if images contain the face(s) of over 10,000 recognized celebrities. Explore our pre-built, ready-to-use image recognition models to suit your specific needs.  Something went wrong while submitting the form. vision computer For example, lowered water levels prevent cooling in industrial manufacturing with a direct impact on production. Autonomous vehicles need real-time object detection, which leads to collision avoidance and helps to prevent claims from ever happening. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. This is a time-consuming and resource-intensive manual task. viso.ai joins the NVIDIA Inception Program for AI Startups to accelerate the AI ecosystem across the globe. Computer Vision unveils the context beyond image recognition and understands the relationships between objects. Spotr uses computer vision to analyze a huge, up-to-date image database in which data about your real estate portfolio from different sources are collected. These cookies will be stored in your browser only with your consent. The complexity of risks continuously increases, and new risks related to COVID-19 or long supply chains have increased the complexity of commercial risk assessment. YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. In general, computer vision works in three basic steps: (1) obtaining image data/video from a camera, (2) processing the image with AI models, and (3) understanding the image. The unique no-code/low-code capabilities allow 10x faster time to business value, without writing code from scratch that is difficult and costly to maintain. The cookie is used to store the user consent for the cookies in the category "Analytics".

Something went wrong while submitting the form. vision computer For example, lowered water levels prevent cooling in industrial manufacturing with a direct impact on production. Autonomous vehicles need real-time object detection, which leads to collision avoidance and helps to prevent claims from ever happening. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. This is a time-consuming and resource-intensive manual task. viso.ai joins the NVIDIA Inception Program for AI Startups to accelerate the AI ecosystem across the globe. Computer Vision unveils the context beyond image recognition and understands the relationships between objects. Spotr uses computer vision to analyze a huge, up-to-date image database in which data about your real estate portfolio from different sources are collected. These cookies will be stored in your browser only with your consent. The complexity of risks continuously increases, and new risks related to COVID-19 or long supply chains have increased the complexity of commercial risk assessment. YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. In general, computer vision works in three basic steps: (1) obtaining image data/video from a camera, (2) processing the image with AI models, and (3) understanding the image. The unique no-code/low-code capabilities allow 10x faster time to business value, without writing code from scratch that is difficult and costly to maintain. The cookie is used to store the user consent for the cookies in the category "Analytics".  Zoho sets this cookie for the login function on the website. Use NLP to recognize the intent within text data to respond to questions from customers. The complex and massive amount of data gathered by sensors such as cameras requires machine learning to process information. of an innovation team at AdvantageGo where we build technologies for the future. Visual sensors such as cameras and on-device computer vision provide a highly scalable method for AI vision intelligence. We are living in a world of autonomous vehicles, health tracking sensors, and where a plant can talk to a human. press@researchandmarkets.com Since underwriting tasks involve a high volume of documents, often paper-based, the extraction of structured information from scanned documents plays an important role. Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. It examines the technology's impact across different lines of business and highlights the key players in the space utilizing computer vision within their operations. eccv vision computer springer conference european context objects common features Identify unwanted content such as gore, drugs, explicit nudity or suggestive nudity. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. Key AI insurance applications of computer vision include risk management of existing insurance contracts, risk estimation for new contracts, claims management, and asset or process monitoring in real-time. For example through the automatic screening of property aerial images, which can provide details about the property such as its size or the risk of calamity. Large enterprises, state-owned organizations, and AI startups use the no-code technology to deliver their AI vision solutions much faster, with flexible modules. As these risks grow, computer vision helps insurers to measure property elements like elevation and acreage, as well as monitor space between structures and vegetation or other potentially combustible materials for wildfire mitigation. In combination with internal (ERP) and external data (weather, etc. This cookie is installed by Google Universal Analytics to restrain request rate and thus limit the collection of data on high traffic sites. Spotr is an AI-powered remote property data platform, helping you to gain insights into your insured portfolio. Predict the age, gender or cultural appearances of faces. In addition, insurance customers profit from lower premiums if an insurance company offers such a scheme. In the insurance claims procedure, computer vision delivers objectivity and indisputability. Here, deep learning is expected to accelerate large-scale applications of industrial IoT with vision sensors (cameras). Computer vision is now used in almost every aspect of our life. Within the insurance industry, computer vision is being most utilized by motor and property insurers. Therefore, recent megatrends around Edge Intelligence (Edge AI) move AI processing tasks from the cloud towards the edge, in close proximity to the sensor that produces the data. Contact us here:. To ensure the most secure and best overall experience on our website, we recommend the latest versions of, "Computer Vision in Insurance - Thematic Research", https://www.researchandmarkets.com/r/swsbaj. By Akshay Bajaj, Senior Software Engineer. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Also, inexpensive, common security cameras (CCTV, etc.) As I see it, underwriting excellence and claims processing are the keys that underpin the insurance industry, and in my humble opinion, emerging technologies will fuel the need for new ways to analyse risk, new risks and mitigate claims. Use facial and image recognition, video geolocation and time stamps to reduce risk. Under property and casualty business, the process of inspection and claim settlement is time-consuming when factoring in the time it takes to analyse and assess the damage to a building or car. Please contact the site administrator.

Zoho sets this cookie for the login function on the website. Use NLP to recognize the intent within text data to respond to questions from customers. The complex and massive amount of data gathered by sensors such as cameras requires machine learning to process information. of an innovation team at AdvantageGo where we build technologies for the future. Visual sensors such as cameras and on-device computer vision provide a highly scalable method for AI vision intelligence. We are living in a world of autonomous vehicles, health tracking sensors, and where a plant can talk to a human. press@researchandmarkets.com Since underwriting tasks involve a high volume of documents, often paper-based, the extraction of structured information from scanned documents plays an important role. Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. It examines the technology's impact across different lines of business and highlights the key players in the space utilizing computer vision within their operations. eccv vision computer springer conference european context objects common features Identify unwanted content such as gore, drugs, explicit nudity or suggestive nudity. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. Key AI insurance applications of computer vision include risk management of existing insurance contracts, risk estimation for new contracts, claims management, and asset or process monitoring in real-time. For example through the automatic screening of property aerial images, which can provide details about the property such as its size or the risk of calamity. Large enterprises, state-owned organizations, and AI startups use the no-code technology to deliver their AI vision solutions much faster, with flexible modules. As these risks grow, computer vision helps insurers to measure property elements like elevation and acreage, as well as monitor space between structures and vegetation or other potentially combustible materials for wildfire mitigation. In combination with internal (ERP) and external data (weather, etc. This cookie is installed by Google Universal Analytics to restrain request rate and thus limit the collection of data on high traffic sites. Spotr is an AI-powered remote property data platform, helping you to gain insights into your insured portfolio. Predict the age, gender or cultural appearances of faces. In addition, insurance customers profit from lower premiums if an insurance company offers such a scheme. In the insurance claims procedure, computer vision delivers objectivity and indisputability. Here, deep learning is expected to accelerate large-scale applications of industrial IoT with vision sensors (cameras). Computer vision is now used in almost every aspect of our life. Within the insurance industry, computer vision is being most utilized by motor and property insurers. Therefore, recent megatrends around Edge Intelligence (Edge AI) move AI processing tasks from the cloud towards the edge, in close proximity to the sensor that produces the data. Contact us here:. To ensure the most secure and best overall experience on our website, we recommend the latest versions of, "Computer Vision in Insurance - Thematic Research", https://www.researchandmarkets.com/r/swsbaj. By Akshay Bajaj, Senior Software Engineer. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Also, inexpensive, common security cameras (CCTV, etc.) As I see it, underwriting excellence and claims processing are the keys that underpin the insurance industry, and in my humble opinion, emerging technologies will fuel the need for new ways to analyse risk, new risks and mitigate claims. Use facial and image recognition, video geolocation and time stamps to reduce risk. Under property and casualty business, the process of inspection and claim settlement is time-consuming when factoring in the time it takes to analyse and assess the damage to a building or car. Please contact the site administrator.  After obtaining such predictions, a machine can also predict the cost of replacement. How Computer Vision Can Disrupt the Insurance Market. Manage risk and reduce costs using computer vision to aid in processing damage assessment. Hence, underwriters spend a considerable amount of their time manually transferring data from one software application to another while spending only little time with higher-value tasks such as reasoning from information, selling, or engaging with brokers.

After obtaining such predictions, a machine can also predict the cost of replacement. How Computer Vision Can Disrupt the Insurance Market. Manage risk and reduce costs using computer vision to aid in processing damage assessment. Hence, underwriters spend a considerable amount of their time manually transferring data from one software application to another while spending only little time with higher-value tasks such as reasoning from information, selling, or engaging with brokers.  An example is automated monitoring of compliance with guidelines such as social distancing or mask detection, where applications provide a risk score to quantify and track risks across multiple locations (distributed AIoT systems). This cookie has not yet been given a description. Vision-based condition monitoring helps to take preventative measures against machine failure and lower business interruption risk while increasing overall equipment effectiveness. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. Build models for topic and sentiment analysis and smart reply. As described earlier, the new megatrends shift AI closer to the edge. Ive outlined a few case scenarios. Detect toxic, racist, obscene or threatening language or build your own custom moderation model. When a car is damaged in an accident, the liable party files an insurance claim and undergoes a collision damage assessment.

An example is automated monitoring of compliance with guidelines such as social distancing or mask detection, where applications provide a risk score to quantify and track risks across multiple locations (distributed AIoT systems). This cookie has not yet been given a description. Vision-based condition monitoring helps to take preventative measures against machine failure and lower business interruption risk while increasing overall equipment effectiveness. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. Build models for topic and sentiment analysis and smart reply. As described earlier, the new megatrends shift AI closer to the edge. Ive outlined a few case scenarios. Detect toxic, racist, obscene or threatening language or build your own custom moderation model. When a car is damaged in an accident, the liable party files an insurance claim and undergoes a collision damage assessment.  Better manage risk and for personal and commercial businesses applying for reinsurance. Analyze images and returns numerical vectors that represent each detected face in the image in a 1024-dimensional space computed by our. But also in non-life insurance, behavioral data is essential. Recognize textures and patterns in a two-dimensional image e.g., feathers, woodgrain, petrified wood, glacial ice and overarching descriptive concepts (veined, metallic). eye strain computer health screen vision eyes tired habits syndrome tips give sore feeling hours few looking digital Computer vision makes it possible for computers to interpret and understand the visual world, allowing insurers to expand their analytics capabilities towards new domains. Complex, data-hungry algorithms require high computing resources and are difficult to execute in constrained environments. In the insurance sector, innovation is driven by emerging AI technologies that impact the entire value chain. Traditional, cloud-based web applications require centralized processing in the cloud (data offloading), limiting adoption because of limited reliability, security, privacy, performance, connectivity, latency, and scalability. Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . For example, in life insurance or health insurance, it is expected that over 40% of risk information is obtainable from behavior monitoring alone. What Ive outlined so far is just the tip of the iceberg regarding Computer Vision capabilities. In terms of underwriting, a roof is one of the most important features of a home. Since its inception, predicting the future and estimating risks have been at the core of the industry. New risk management systems can become so powerful and disruptive to change insurance business models upside down, from pooling to personalizing risks. An easy-to-understand guide to modern machine vision, how it works, and how it relates to computer vision. Drones are increasingly being used to perform damage inspections. DUBLIN--(BUSINESS WIRE)--The "Computer Vision in Insurance - Thematic Research" report has been added to ResearchAndMarkets.com's offering. It allows the website owner to implement or change the website's content in real-time. Hence, the data of visual insights provide further relevant information. Previously, insurance companies relied on information provided by the homeowner or agent. A clear example of new ways of using data is behavioural analytics which is increasingly used in health care or car insurance. The extracted information can be used for creating recommendations for the underwriter, such as referring to similar cases. Dont have time to chat right now?

Better manage risk and for personal and commercial businesses applying for reinsurance. Analyze images and returns numerical vectors that represent each detected face in the image in a 1024-dimensional space computed by our. But also in non-life insurance, behavioral data is essential. Recognize textures and patterns in a two-dimensional image e.g., feathers, woodgrain, petrified wood, glacial ice and overarching descriptive concepts (veined, metallic). eye strain computer health screen vision eyes tired habits syndrome tips give sore feeling hours few looking digital Computer vision makes it possible for computers to interpret and understand the visual world, allowing insurers to expand their analytics capabilities towards new domains. Complex, data-hungry algorithms require high computing resources and are difficult to execute in constrained environments. In the insurance sector, innovation is driven by emerging AI technologies that impact the entire value chain. Traditional, cloud-based web applications require centralized processing in the cloud (data offloading), limiting adoption because of limited reliability, security, privacy, performance, connectivity, latency, and scalability. Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . For example, in life insurance or health insurance, it is expected that over 40% of risk information is obtainable from behavior monitoring alone. What Ive outlined so far is just the tip of the iceberg regarding Computer Vision capabilities. In terms of underwriting, a roof is one of the most important features of a home. Since its inception, predicting the future and estimating risks have been at the core of the industry. New risk management systems can become so powerful and disruptive to change insurance business models upside down, from pooling to personalizing risks. An easy-to-understand guide to modern machine vision, how it works, and how it relates to computer vision. Drones are increasingly being used to perform damage inspections. DUBLIN--(BUSINESS WIRE)--The "Computer Vision in Insurance - Thematic Research" report has been added to ResearchAndMarkets.com's offering. It allows the website owner to implement or change the website's content in real-time. Hence, the data of visual insights provide further relevant information. Previously, insurance companies relied on information provided by the homeowner or agent. A clear example of new ways of using data is behavioural analytics which is increasingly used in health care or car insurance. The extracted information can be used for creating recommendations for the underwriter, such as referring to similar cases. Dont have time to chat right now?  Many applications of machine learning depend on massive amounts of data to train the ML model. Only a few productive implementations are widely deployed as of today, something that is very likely to change in the near future. Use computer vision and satellite imagery to detect presence of pools, trampolines, flood lines and upgrades that affect property values. deltecbank Typically it has relied on data that comes from the homeowner or agent, public records, or visual inspections. Detect items of clothing or fashion-related items.

Many applications of machine learning depend on massive amounts of data to train the ML model. Only a few productive implementations are widely deployed as of today, something that is very likely to change in the near future. Use computer vision and satellite imagery to detect presence of pools, trampolines, flood lines and upgrades that affect property values. deltecbank Typically it has relied on data that comes from the homeowner or agent, public records, or visual inspections. Detect items of clothing or fashion-related items.  Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. Until now, and despite the high potential in IoT, insurers lack ways of finding relevant information in the mass of sensor data. Key insurance technology trends for the adoption of AI vision and deep learning, New and valuable real-world use cases of computer vision in Insurtech, Practical examples of applications in the insurance industry, Application #1: Risk assessment with computer vision, Application #2: Industrial IoT (IIoT) and Artificial Intelligence, Application #3: Forward-looking Risk Estimation, Application #4: AI vision in underwriting process automation, Application #5: Fraud prevention with AI vision, Application #6: AI to understand new and complex risks. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. About 80% of data in todays insurance companies is text. The relevance of big data and AI insurance applications is substantiated by the ability to collect, process, and understand large amounts of data. To ensure the most secure and best overall experience on our website we recommend the latest versions of, Internet Explorer is no longer supported. Thank you! The publisher estimates the computer vision market to be worth $28bn in 2030. Personalised data allows for custom pricing of insurance.

Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. Until now, and despite the high potential in IoT, insurers lack ways of finding relevant information in the mass of sensor data. Key insurance technology trends for the adoption of AI vision and deep learning, New and valuable real-world use cases of computer vision in Insurtech, Practical examples of applications in the insurance industry, Application #1: Risk assessment with computer vision, Application #2: Industrial IoT (IIoT) and Artificial Intelligence, Application #3: Forward-looking Risk Estimation, Application #4: AI vision in underwriting process automation, Application #5: Fraud prevention with AI vision, Application #6: AI to understand new and complex risks. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. About 80% of data in todays insurance companies is text. The relevance of big data and AI insurance applications is substantiated by the ability to collect, process, and understand large amounts of data. To ensure the most secure and best overall experience on our website we recommend the latest versions of, Internet Explorer is no longer supported. Thank you! The publisher estimates the computer vision market to be worth $28bn in 2030. Personalised data allows for custom pricing of insurance.  Within seconds, computer vision can find the damage and assess the amount of damage to a car. When it comes to property insurance, customers tend to hold onto their policy until they physically move somewhere else. The quantitative assessment of such risks is critical for the pricing of insurance products, and to design parametric products. Connected devices like cars or smartwatches allow insurers to estimate and anticipate risk associated with customer behaviour. Ultimately improving the collaboration between agents and customers for a better customer experience.

Within seconds, computer vision can find the damage and assess the amount of damage to a car. When it comes to property insurance, customers tend to hold onto their policy until they physically move somewhere else. The quantitative assessment of such risks is critical for the pricing of insurance products, and to design parametric products. Connected devices like cars or smartwatches allow insurers to estimate and anticipate risk associated with customer behaviour. Ultimately improving the collaboration between agents and customers for a better customer experience.  But with the emergence of new risks like climate change, additional regulations and more demanding customers the industry needs to innovate. The primary goal is to assess the necessary repair work as well as the amount of compensation. Here, artificial intelligence is used for automated interactions, cognitive applications, and automatically providing relevant information using semi-structured information. A popular example is remote sensing, for example, to analyze flood risk. In a data-driven industry like insurance, blind spots come at a cost. vision deep learning computer Were always looking to improve, so please let us know why you are not interested in using Computer Vision with Viso Suite. If you're encountering a technical or payment issue, the customer support team will be happy to assist you.

But with the emergence of new risks like climate change, additional regulations and more demanding customers the industry needs to innovate. The primary goal is to assess the necessary repair work as well as the amount of compensation. Here, artificial intelligence is used for automated interactions, cognitive applications, and automatically providing relevant information using semi-structured information. A popular example is remote sensing, for example, to analyze flood risk. In a data-driven industry like insurance, blind spots come at a cost. vision deep learning computer Were always looking to improve, so please let us know why you are not interested in using Computer Vision with Viso Suite. If you're encountering a technical or payment issue, the customer support team will be happy to assist you.